Route Network

Aeroflot Group’s route network development1

In 2018, Aeroflot Group’s airlines (Aeroflot, Rossiya, and Aurora) operated 318 scheduled routes to 56 countries (including Russia). Pobeda airline network comprises 103 destinations, including 57 unique for the Group. With Pobeda taken into account, the Group’s airlines operated flights to 57 countries.

In 2018, the number of Aeroflot Group’s scheduled routes grew 14.4% year-on-year, with domestic and international scheduled routes increasing by 23.2% and 5.1%, respectively. The total number of the Group-operated routes increased by 8,4% to 465.

| 2017 | 2018 | Change, % | |||||||

|---|---|---|---|---|---|---|---|---|---|

| sch. | chart. | total | sch. | chart. | total | sch. | chart. | total | |

| International | 136 | 146 | 240 | 143 | 150 | 250 | 5.1 | 2.7 | 4.2 |

| Domestic | 142 | 86 | 189 | 175 | 92 | 215 | 23.2 | 7.0 | 13.8 |

| Medium-haul | 252 | 219 | 392 | 290 | 232 | 428 | 15.1 | 5.9 | 9.2 |

| Long-haul | 26 | 13 | 37 | 28 | 10 | 37 | 7.7 | (23.1) | – |

| Total | 278 | 232 | 429 | 318 | 242 | 465 | 14.4 | 4.3 | 8.4 |

During 2018, Aeroflot and Rossiya airlines launched scheduled flights from Sheremetyevo airport to 20 new destinations, including 8 domestic and 12 international.

Rossiya airline’s flights from Saint Petersburg to Almaty and Astana under commercial management of PJSC Aeroflot were discontinued as part of the Group network optimisation effort and performance improvement. Following the transfer of Rossiya airline’s scheduled flights operated from Moscow to Sheremetyevo airport and the network optimisation, flights from Moscow to Anapa, Kazan, Barcelona, and Makhachkala were discontinued as these routes are serviced by Aeroflot airline.

Aeroflot Group continued increasing the frequency of scheduled service to the most popular destinations, with the average weekly frequency of scheduled flights in 2018 growing by 7.2% year-on-year (from 13.1 to 14.1). This figure grew 8.2% (from 10.9 to 11.8) for international and 6.7% (from 15.5 to 16.5) for domestic scheduled routes. The number of Aeroflot Group’s scheduled flights grew by 8.1% year-on-year.

In planning its flight schedule, Aeroflot Group focuses on:

- improving the accessibility of Russia’s regions

- improving customer experience of non-stop flights

- optimising targeted connections on intercontinental (Asia–Europe, North America–Middle East), and inter-regional routes (Far East/Urals–Centre/South)

- developing hub at Sheremetyevo airport

- growing the market share on the routes of presence and launching new services to destinations with high transfer traffic potential.

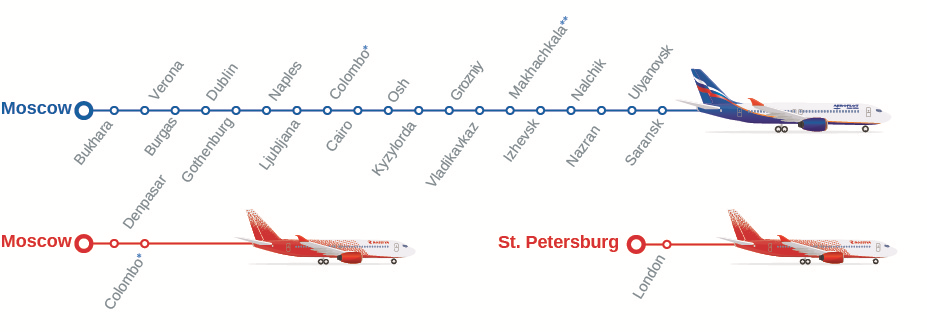

* In December 2018, Aeroflot airline’s flight to Colombo was switched to Rossiya’s operations.

** In 2018, Aeroflot launched flights to Makhachkala from Sheremetyevo airport. The route was previously serviced by Rossiya airline from

Vnukovo airport.

Air services during the World Cup

Aeroflot’s route network comprises scheduled flights between Moscow and all the cities that hosted World Cup in 2018. With Rossiya subsidiary’s route network and Pobeda’s flights taken into account, we have provided a wide range of travel options for direct and transfer passengers. To improve air services between the host cities, additional domestic flights were launched during the days of the period of the championship. Specifically, during the group stage, Aeroflot airline operated services on the Sochi–Kazan, Kazan– Kaliningrad, Kazan–Yekaterinburg, Volgograd– Nizhny Novgorod, and Volgograd–Kazan routes. Aeroflot also flew 11 additional flights on the Moscow–New York–Moscow route, as well as operated high-capacity aircraft on the most popular routes, with its destinations in Europe and the Americas accounting for the bulk of the passenger traffic.

Aeroflot Airline’s route network development

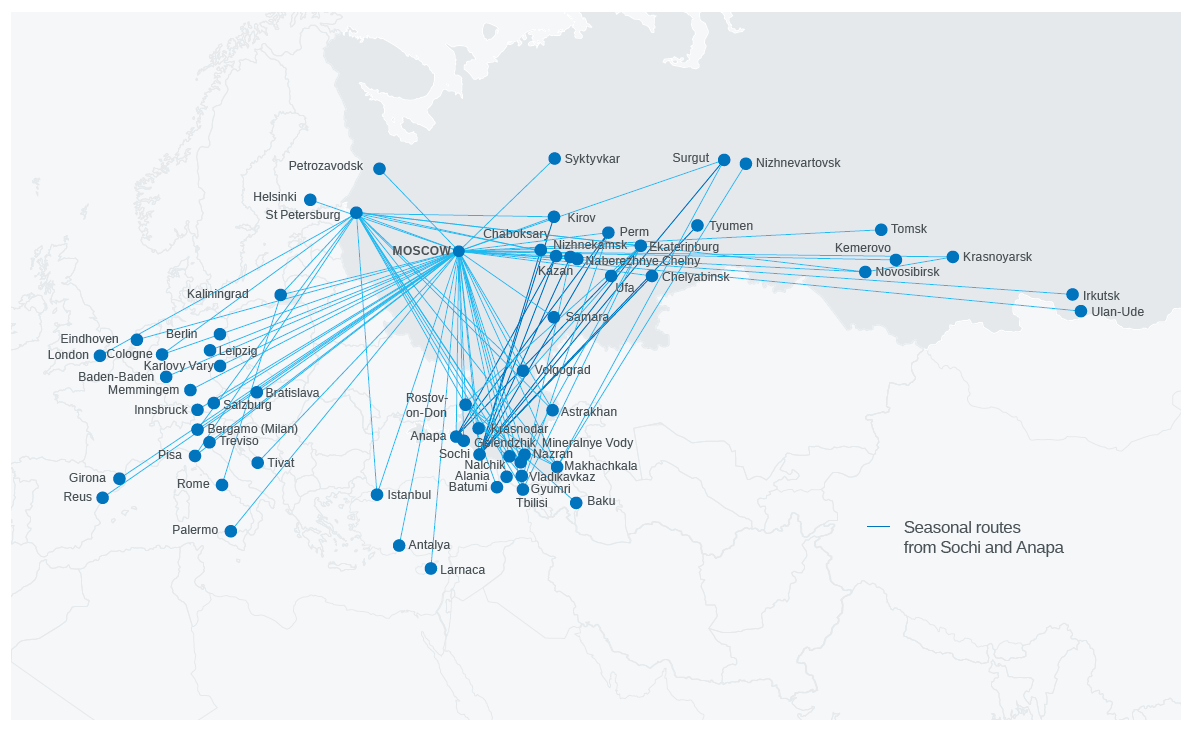

In 2018, Aeroflot airline’s network covered 163 scheduled routes to 56 countries (including Russia), with the number of its scheduled routes growing by 17.3% year-on-year.

| 2017 | 2018 | Change, % | |||||||

|---|---|---|---|---|---|---|---|---|---|

| sch. | chart. | total | sch. | chart. | total | sch. | chart. | total | |

| International | 89 | 31 | 103 | 100 | 48 | 123 | 12.4 | 54.8 | 19.4 |

| Domestic | 50 | 25 | 64 | 63 | 52 | 93 | 26.0 | 108.0 | 45.3 |

| Medium-haul | 114 | 56 | 142 | 137 | 97 | 188 | 20.2 | 73.2 | 32.4 |

| Long-haul | 25 | – | 25 | 26 | 3 | 28 | 4.0 | – | 12.0 |

| Total | 139 | 56 | 167 | 163 | 100 | 216 | 17.3 | 78.6 | 29.3 |

In 2018, the number of Aeroflot airline’s scheduled flights grew 12.1% year-on-year due to the increase in capacity on the most popular routes and the launch of new destinations.

- The Middle East segment reported the highest growth due to increased frequencies of flights to Turkey and Dubai. In addition, scheduled flights to Cairo, Egypt’s capital, were resumed after a long hiatus.

- European destinations saw the number of scheduled flights increase by 12.0% driven by increased frequencies and the launch of direct service from Moscow to Naples, Verona, and Burgas.

- The number of scheduled flights to the CIS increased by 3.2%, driven by the launch of direct services to Bukhara, Kyzylorda, and Osh routes and more frequent flights to Astana and Aktobe.

- The number of scheduled flights to Southeast Asia was up 4.6%, including due to the higher frequency of flights to Bangkok, Malé, Phuket, and Ho Chi Minh City, as well as the launch of flights to Denpasar and Colombo.

- The number of scheduled flights to North and Central America was up by 1.3% driven by the higher frequency of flights to Miami.

- Domestic destinations saw the number

of scheduled flights increase by 6.7%.

In particular, we increased the number of flights

from Moscow to Arkhangelsk, Belgorod,

Volgograd, Yekaterinburg, Kazan, Kemerovo,

Krasnoyarsk, Murmansk, Nizhnevartovsk,

Novosibirsk, Novy Urengoy, Perm, Saint

Petersburg, Saratov, Surgut, Syktyvkar,

Ufa, Khanty-Mansiysk, and Chelyabinsk.

Aeroflot airline launched flights to the capitals

of the North Caucasus regions of Russia ,

as well as to Saransk, Izhevsk, and Ulyanovsk.

The connectivity ratio for Aeroflot airline’s own flights improved from 21.2 in 2017 to 22.0 in 2018.

The average weekly frequency of Aeroflot airline’s scheduled flights grew 5.9%, from 17.0 to 18.0 flights per route per week. International and domestic scheduled destinations saw the frequency grow by 5.7% (from 13.1 to 13.9 flights) and 5.3% (from 24.2 to 25.5 flights), respectively.

Subsidiary airlines’ route network development

Rossiya airline

In 2018, Rossiya airline operated scheduled services on 144 routes to 22 countries (100 domestic and 44 international), including 83 routes under commercial management of PJSC Aeroflot.

Rossiya airline’s route network structure underwent planned yet fundamental changes during 2018. In October, with the launch of the winter flight schedule, Rossiya airline’s scheduled flights under commercial management of PJSC Aeroflot were transferred from Vnukovo to Sheremetyevo airport. The consolidation of flights within Aeroflot’s hub and the manifold increase in the connectivity potential of Rossiya airline’s flights have significantly broadened the route planning options for passengers. Rossiya airline’s flights are integrated into Aeroflot’s Sheremetyevo airport-based wave connectivity scheme, which supports transfer traffic flows via the largest hub in Eastern Europe to the standards of leading network carriers.

Thus, Moscow flights are consolidated in Aeroflot Group’s single hub, Sheremetyevo airport, while Pulkovo, the airline’s historical base airport, continues to develop as a regional transport hub servicing the North-West of Russia. In early 2018, Rossiya airline started operating flights from Moscow (using Boeing 747 and Boeing 777 aircraft) under the flat fare programme to improve transport accessibility for population in the Russian Far East.

Flights from Moscow (Sheremetyevo) to Denpasar, Bangkok, and Colombo were launched in the winter 2018/19 season.

Aurora airline

Aurora is focused on securing transport accessibility and accommodating the demand for flights in the Russian Far East and to major cities in Siberia. Aurora also operates international services from Khabarovsk, Vladivostok, and Yuzhno-Sakhalinsk to South Korea, China, and Japan.

In 2018, Aurora airline operated scheduled services on 49 routes (38 domestic and 11 international) to four countries, including 21 routes under commercial management of PJSC Aeroflot. Local flights between major cities and remote destinations are a socially important part of Aurora’s route network covering 14 socially important destinations in 2018.

Dalnerechensk–Khabarovsk and Khabarovsk– Nikolayevsk-on-Amur scheduled domestic flights were launched in 2018. The frequency of flights from Vladivostok to Yakutsk and Petropavlovsk- Kamchatsky was increased. The frequency of Vladivostok–Seoul international flight was also increased, and flights were resumed from Yuzhno- Sakhalinsk to Tokyo.

Pobeda airline

Pobeda airline actively expanded its route network in 2018. Whereas under the summer 2018 schedule it operated 72 routes (42 of which were unique for the Group), the number of routes in the winter 2018 schedule increased to 85 (45 of which were unique for the Group). Overall in 2018, Pobeda airline operated 103 routes, 57 of which were unique and complemented the Group’s route network. Pobeda airline is based at Vnukovo airport in Moscow, and also operates flights from a number of regional airports in Russia.

Key areas of route network development in 2018:

- Continued development of route network from Moscow to domestic and international destinations. In developing its network of routes from Moscow, Pobeda prioritises serving significant markets and launching and ramping up new routes not serviced by other airlines within the Group. In particular, flights from Moscow to Ulan-Ude, Petrozavodsk, Palermo, Salzburg, Innsbruck, Karlovy Vary, Leipzig, Baden-Baden, and a number of other destinations were unique to Pobeda in 2018 within the Group’s route network

- Regional development, including increasing the number of flights between Russia’s major cities and to the most popular destinations abroad. Expansion in the Saint Petersburg market during the year focused on the most popular destinations in Russia. New routes were also launched from Yekaterinburg, Sochi, and several other cities

Pobeda airline maintained price leadership among all Russian airlines in 2018, according to the largest ticket sales agents. The airline sold over 400 thousand tickets for as low as RUB 499/999, all airport taxes included.

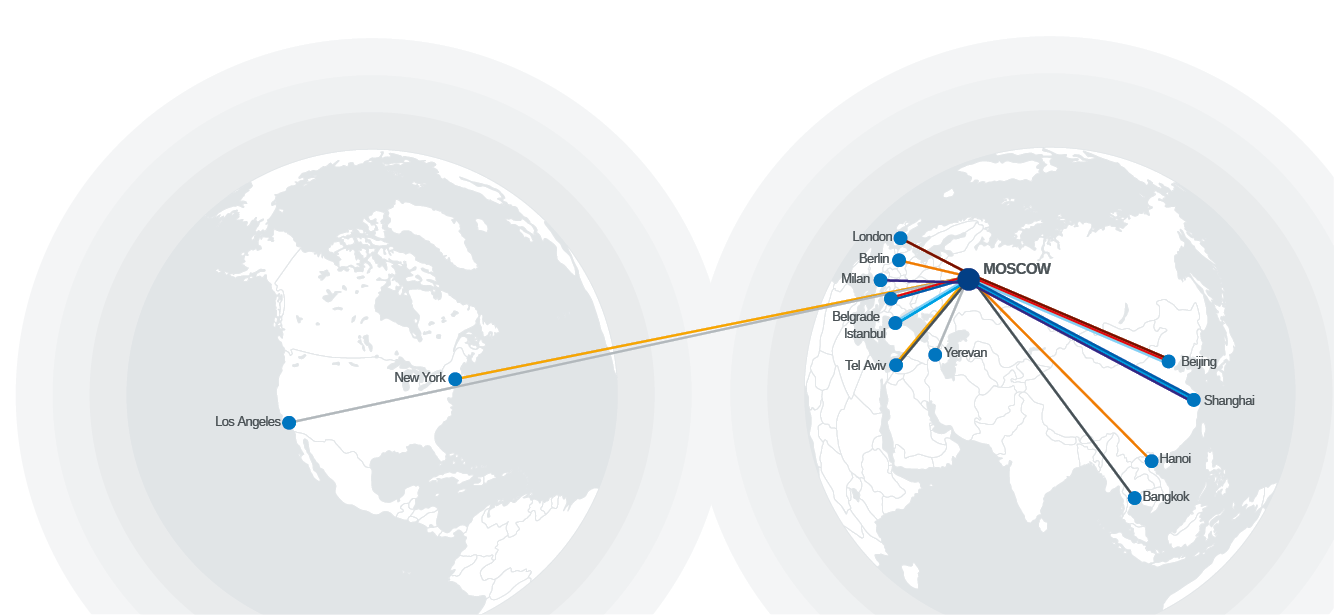

Transit development

The bulk of the Group’s transit traffic is handled by Aeroflot airline, which takes advantage of Russia’s beneficial geographical position to pick up passenger traffic between Europe and Asia and from other O&D markets.

In 2018, the total transit traffic on Aeroflot airline’s flights rose 3.6% year-on-year to 14.4 million passengers. Passengers in transit accounted for 40.7% of Aeroflot airline’s total passenger traffic (42.9% in 2017).

Transit flows between Russia and other countries made up the bulk of Aeroflot airline’s transfer passenger traffic, or 15.7% of the total. International transit traffic has the highest impact with a share of 13.6%, or 4.8 million transfer passengers. The domestic transit traffic was 11.4%.

(%)

Aeroflot’s History

1953 – China (Beijing)

1954 – France (Paris)

1959 – United Kingdom (London)

1968 – United States (New York, NY)

1972 – Germany (Frankfurt)

1976 – Spain (Madrid)

Developing the route network and increasing flight frequencies: permits and designations

In order to ensure its strategic development, the Group continuously cooperates with regulators to obtain permits and designations to launch new routes and increase flight frequencies for existing ones. In 2018, the Federal Air Transport Agency issued the following operating permits to PJSC Aeroflot and its subsidiaries under the commercial management of PJSC Aeroflot:

AEROFLOT AIRLINE

+15 new permits

to operate international scheduled

passenger services from Moscow

to Ashgabat, Bukhara, Victoria,

Gothenburg, Dublin, Colombo, Kos,

Ljubljana, Marseille, Nha Trang,

Osh, Port Louis, Ürümqi, Chengdu,

and Shenyang

+17 additional permits

to increase the frequencies

of international scheduled passenger

services from Moscow to Bangkok,

Belgrade, Brussels, Budapest,

Bucharest, Valencia, Guangzhou, Dubai,

Lyon, Malé, Paris, Beijing, Seoul, Sofia,

Istanbul, Tashkent, and Shanghai

ROSSIYA AIRLINE

+4 new permits

to operate international scheduled

passenger services from Moscow

to Goa, Colombo, and Denpasar,

and from Saint Petersburg to London

+4 additional permits

to increase the frequencies

of international scheduled passenger

services from Saint Petersburg

to Larnaca, Munich, Samarkand,

and Tashkent

+8 new permits

to operate international non-scheduled

(charter) passenger services

from Moscow to Barcelona, Burgas,

Varna, and Sofia, from Saint Petersburg

to Burgas, Varna, and Barcelona,

and from Yekaterinburg to Barcelona

AURORA AIRLINE

+1 new permit

to operate international scheduled

passenger service from Vladivostok

to Shanghai

+1 additional permit

for JSC Aurora Airlines to increase

the frequency of international scheduled

passenger service from Yuzhno-

Sakhalinsk to Tokyo

Aeroflot’s History

Designations for PJSC Aeroflot as a regular carrier were obtained from the Russian Ministry of Foreign Affairs for the Moscow– Bukhara, Moscow–Dublin, Moscow–Ljubljana, Moscow–Osh, Moscow–Gothenburg, Moscow–Colombo, Moscow–Ürümqi, Moscow–Chengdu, and Moscow–Chenyang routes.

In March 2018, permits were renewed for Aeroflot airline (for 17 routes) and Rossiya airline (for 15 routes) to operate services on Transaero’s routes for one year (until March 2019).

Aeroflot airline waived two permits to operate international scheduled passenger services from Moscow to Ashgabat and Kaunas in 2018.

Rossiya airline waived one permit to operate international scheduled passenger service from Saint Petersburg to Beijing, inherited from Transaero. The permit was waived due to not commencing the air service.

Aurora airline waived five permits to operate international scheduled passenger services on routes: Anadyr–Anchorage, Vladivostok–Petropavlovsk-Kamchatsky–Anchorage, Vladivostok–Anchorage, Yuzhno-Sakhalinsk–Anchorage, and Novosibirsk–Tashkent.

Codeshare and interline agreements

Codeshare agreements enable Aeroflot Group to expand its route network adding both point-topoint flights and flights beyond the partner hubs, as well as increase the frequencies of flights on existing routes.

In 2018, joint flights were started with Aerolineas Argentinas on the Moscow–Madrid–Buenos Aires route and with Aerovias de Mexico (Aeromexico) on the Moscow–Paris/Madrid/Amsterdam/London– Mexico City routes. Codeshare agreements with Air Malta, Bulgaria Air, Air France, Korean Air, Saudi Arabian Airlines, Air Serbia, and with Aurora and Rossiya subsidiary airlines were extended to new routes.

PJSC Aeroflot had 30 codeshare agreements with foreign and Russian airlines in 2018:

- Twenty-two agreements under which Aeroflot airline acted both as a partner operator and a marketing operator: Aerolineas Argentinas, Aerovias de Mexico, Air Europa, Air France, Air Baltic, Air Serbia, Alitalia, Bulgaria Air, Czech Airlines, China Eastern Airlines, China Southern Airlines, Delta Air Lines, Finnair, Garuda Indonesia, Icelandair, Kenya Airways, KLM, Korean Air, LOT Polish Airlines, MIAT, Saudi Arabian Airlines, and Siberia Airlines

- Three agreements under which Aeroflot airline acted as a partner operator only: Cubana de Aviacion, Middle East Airlines, and TAROM

- Three agreements under which Aeroflot airline acted only as a marketing operator, selling partner flights under its code: Air Malta, Adria Airways, and Bangkok Airways

- Two agreements with Aeroflot Group’s airlines under commercial management arrangements for operation of joint flights – with Rossiya and Aurora

PJSC Aeroflot’s major partners by volume of business generated through codeshare agreements were Alitalia, Air France, Air Europa, Czech Airlines, Finnair, and KLM among foreign airlines, and Aeroflot Group’s airlines and Siberia Airlines among Russian carriers.

Aeroflot’s key priorities in cooperation under codeshare agreements:

- Building up Aeroflot’s presence in promising markets

- Gaining a foothold in the markets where certain restrictions apply

- Further improving the existing route network, including through the expansion of the marketing flight network

- More efficient use of owned aircraft fleet

As at the end of 2018, PJSC Aeroflot had interline agreements with 132 carriers, including four Russian carriers and four CIS-based airlines.

Membership in the SkyTeam Alliance

As a SkyTeam partner, Aeroflot carried over 545 thousand passengers in 2018 under codeshare and interline agreements with other SkyTeam Alliance members. About 313 thousand Aeroflot passengers were carried by its SkyTeam partners.

As a member of the SkyTeam Alliance, Aeroflot can expand its route network while offering its customers access to the global Alliance’s unique product and providing Aeroflot Bonus members with an opportunity to enjoy the privileges on the flights of other SkyTeam Alliance members.

In 2018, the Alliance’s aggregate route network comprised 1,074 destinations in 177 countries. SkyTeam’s members, including Aeroflot airline, were making a total of 16,609 flights on a daily basis.

SkyTeam Alliance had 20 members in 2018, including Aeroflot – Russian Airlines, Aerolineas Argentinas, Aeromexico, Air Europa, Air France, KLM, Alitalia, China Airlines, China Eastern Airlines, China Southern Airlines, Czech Airlines, Delta Air Lines, Kenya Airways, Korean Air, Middle East Airlines, Saudi Arabian Airlines, TAROM, Vietnam Airlines, Xiamen Airlines, and Garuda Indonesia. In early 2019, China Southern Airlines left SkyTeam, and the Alliance management approved a new development strategy.

1 Due to the separate status of the low-cost segment and its business specifics, the data on Aeroflot Group’s route network includes the routes of Aeroflot airline and subsidiaries excluding Pobeda, unless otherwise stated.