Risk Management

Risk management system

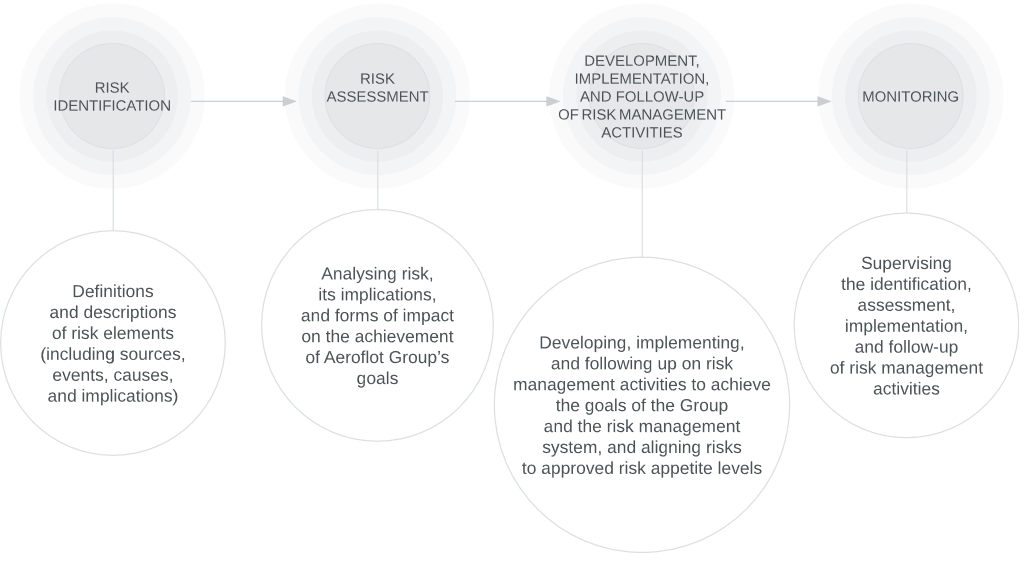

In 2018, Aeroflot Group continued to enhance a comprehensive system that helps promptly identify risks that affect the Company, assess their materiality, and take measures to minimise both the likelihood of risks being realised and losses they can lead to. Our risk management activities are governed by the Regulations on Aeroflot Group’s Risk Management System approved in 2015 and updated in 2017. The document lays down the framework for a unified risk assessment and management methodology: goals, objectives, and principles of setting up and operating the corporate risk management system (CRMS), as well as the principles of the distribution of rights, obligations, and responsibilities of participants of the risk management system at PJSC Aeroflot and its controlled entities.

Risk management is applied across all management levels and functional and project areas. Risk management roles are distributed among the Board of Directors, the Audit Committee of the Board of Directors, the Management Board, and business units of PJSC Aeroflot. The Company has set up the Risk Management Department to:

- provide overall coordination of risk management processes

- develop guidelines to govern risk management processes

- arrange personnel training in risk management and internal control

- review the risk portfolio and develop proposals on response strategy and reallocation of resources to manage respective risks

- prepare consolidated risk reports

- perform day-to-day monitoring of the risk management process across business units and controlled entities

- prepare information and inform the Board of Directors and executive bodies on the effectiveness of the risk management process.

PJSC Aeroflot’s business units and the Risk Management Department make comprehensive efforts to identify and assess risks, as well as prepare the Risk Register and Risk Map. The Board of Directors of PJSC Aeroflot annually reviews and approves the Risk Register, Risk Map, and Risk Appetite Statement of Aeroflot Group.

The Risk Map is a map of the most significant risks which covers risks of underperformance against budgeted targets, including due to changes in market risk factors, and operational risks directly associated with availability/airworthiness of aircraft and customer service quality. The following market risks realised in 2018 had the greatest impact on Aeroflot Group’s operations: increase in jet fuel price, exchange rate fluctuations, and a rise in interest rates. Control over PJSC Aeroflot’s financial and business activities is exercised by the Audit Committee of the Board of Directors, Revision Committee, Internal Audit Department, and Risk Management Department. An independent auditor is engaged to audit PJSC Aeroflot’s accounting statements prepared under the Russian Accounting Standards (RAS) and the International Financial Reporting Standards (IFRS).

Officers responsible for interaction with PJSC Aeroflot on the implementation and operation of the CRMS have been designated at PJSC Aeroflot’s controlled entities, with controlled entities performing procedures to identify and assess risks.

Risk management structure

Participants, their roles, responsibilities and interfaces within the corporate risk management system

GENERAL MEETING OF SHAREHOLDERS

Making decisions on matters of the General Meeting of Shareholders

BOARD OF DIRECTORS

Determining key parameters of the CRMS (goals, objectives, operating principles, architecture, risk appetite, etc.)

Managing risks within the authority of the Board of Directors

Making decisions on providing necessary resources to the CRMS participants

Assessing the CRMS performance Approving the Risk Register and Risk Map

EXECUTIVE MANAGEMENT

Development, operational management and monitoring of the CRMS

Risk management within the authority of the CRMS participants at the executive management level

Allocation of resources among the CRMS participants Identifying instruments and parameters for hedging

Selection procedures for counterparties to hedge financial risks

Decisions on the roles, responsibilities, and cooperation procedure of the management tier and line management tier stakeholders as a part of hedging transactions

LINE MANAGEMENT

Executing, performance monitoring, and continuously improving risk management procedures

Risk management within its authority

Enhancement of the risk management system

Selected activities implemented in 2018 to enhance integrated risk management at Aeroflot Group:

- Updates were made to PJSC Aeroflot’s Risk Management Standard, which implements the concept of a unified risk management methodology across Aeroflot Group

- Internal regulations were adopted across PJSC Aeroflot’s controlled entities to implement Aeroflot Group’s unified risk management methodology

- The Board of Directors of PJSC Aeroflot approved the updated Aeroflot Group’s Risk Register and Risk Map

- The Board of Directors of PJSC Aeroflot approved the Risk Appetite Statement of Aeroflot Group

- Employees of PJSC Aeroflot’s controlled entities were trained in risk management and internal control

- Prompt communication procedures were set up to support interaction between PJSC Aeroflot’s Risk Management Department and risk coordinators at PJSC Aeroflot’s controlled entities within the CRMS

- Monthly reporting on realised risks and risk appetite compliance by PJSC Aeroflot’s controlled entities was organised within the CRMS

In order to improve its risk management performance, Aeroflot Group carries out regular CRMS performance assessments both as part of day-to-day operations and in the form of in-house or independent third-party assessments. The management, the Audit Committee of the Board of Directors, and the Board of Directors receive regular reports on risk management and the CRMS performance across Aeroflot Group.

| RISK | DESCRIPTION | MITIGATION |

|---|---|---|

| Market risks | Risks of underperformance against targets (financial, operating, strategic, etc.) due to exchange rate, commodity price, or market interest rate fluctuations | To reduce market risk implications for financial performance, PJSC Aeroflot seeks to balance out revenues and liabilities in each currency. In light of the limits of operational (or natural) hedging, we diversify debt across currencies and instruments, and regularly consider financial hedging options involving derivatives on aviation fuel and exchange rates. We review the use of interest rate hedges on a regular basis. No transactions were undertaken in 2018 to hedge foreign exchange risk or fuel price risk. For details on the impact of realised risks on the Group see below. |

| Credit risk | Risk of incurring losses from a potential failure by a counterparty to meet its contractual obligations to Aeroflot Group companies | A systemic approach is used to manage credit risk, aimed at preventing the risk occurring or minimising financial losses should it occur. The approach involves: · use of financial coverage clause in service contracts with deferred payments · capping agent sales volumes, prepayments, and receivables from counterparties · regular credit quality assessments of counterparties (based on credit ratings and probability of default ratings) · regular recalculation of financial coverage for credit risk · regular monitoring of credit risk alerting the Company to potential counterparty defaults and giving it time to respond in advance · credit risk limits assigned to banks and financial companies. |

| Liquidity risk | Risk of incurring losses from the inability of an organisation to fully meet its obligations as they fall due | To mitigate liquidity risk, we: · plan cash inflows and outflows to identify and promptly eliminate potential gaps by raising short-term loans from partner credit institutions · have established controls over the use of working capital by launching an operational system to enable early warnings of cash gaps, building a sufficient liquidity cushion, and prompt raising of funds in the money market, as well as maximising the efficient use of free cash · regularly review limits for credit, deposit, and foreign exchange transactions with financial institutions. |

Capital markets access risks |

Risks of incurring losses from the Group’s inability to raise debt for its financial and business activities on acceptable terms |

The market situation is monitored, a competitive environment for credit institutions is maintained, measures to enhance the Group’s equity story are taken, and relationships with credit rating agencies are managed. |

| Strategic risks | Risks of incurring losses from errors (flaws) made when making decisions on the Group’s business and growth strategy | Efforts are taken to minimise risks related to the Aeroflot Group Development Strategy, including making decisions to optimise operations, cut costs, and increase resource efficiency. |

| Risk of terrorism or armed conflicts | Risks of incurring losses from armed conflicts, terrorist attacks, or threats of attacks | PJSC Aeroflot cooperates with airport security services, airlines, and law enforcement authorities in implementing a range of aviation and transportation security activities to prevent unlawful interference in airline operations and ensure passenger and staff safety. |

| Risks of epidemics, and man-made or natural disasters | Risks of losses that have external (beyond the control of the Company) causes and are due to epidemics, or man-made or natural disasters | Necessary response measures, including flight suspension, route changes to avoid hazardous regions, extra measures to increase flight safety and to ensure aviation security are taken, and sanitary and epidemiological controls are strengthened. |

| Industry risks | Risks of incurring losses from changes in the air transportation industry | Industry risks are mitigated by:

|

| Environmental risks | Risks of negative changes in the environment or long-term negative implications of these changes caused by anthropogenic impacts | As Russia’s largest carrier, Aeroflot is fully aware of its

responsibility for ensuring high environmental performance

and a sustainable environmental balance across all areas of

its activities. One of its key principles is to improve

aircraft fuel efficiency, which helps reduce the airline’s

environmental footprint. Aeroflot’s environmental policy is

aimed at improving its energy efficiency and environmental

performance:

|

| Service quality risk | Risk of incurring losses from potential refusal by consumers to buy goods or services of the Group companies or outsourced services as a result of products and services offered by the companies failing to meet the quality requirements of consumers | A process to obtain feedback from customers through a number of channels and ensure timely and full consideration of all incoming communications and complaints has been put in place. The demand for services offered is also tracked, and measures are taken to enhance service quality, improve consumer loyalty and experience, and monitor employee compliance with regulations. |

| Reputational risks | Risks that an organisation would incur losses as a result of reduced brand value or negative perceptions of the organisation’s image by customers, counterparties, shareholders, business partners, regulators, and others | Aeroflot takes pride in its reputation as a high-quality, safe carrier and a reliable business partner; therefore, the Company takes all necessary steps to protect its reputation, ensure management integrity and effectiveness, and maintain a positive image among customers, counterparties, shareholders, and business partners. A strong focus is maintained on analysing and improving customer experience, and on deploying cutting-edge customer service technologies. The information environment around Aeroflot Group is continuously monitored and analysed, communications with NGOs are maintained, and procedures are set up to monitor compliance with process flows and regulations. |

Aviation security risks |

Risks of incurring losses from unlawful interference with aviation activities |

The situation is monitored and analysed, and remedial measures are taken to ensure safety at the base airport and destination airports; airports are audited on a regular basis, the level of aviation security at destination airports and compliance with regulations are monitored; independent experts are engaged, and the state of external and internal access control systems is monitored on a 24/7 basis. |

Flight safety risks |

Forecast likelihood and severity of implications of one or several threats being realised with respect to aviation activities related to aircraft operation or directly supporting such operation (flight and ground, commercial and technical) |

Aircraft condition and aircraft maintenance are monitored, along with the corporate healthcare unit’s processes of flight crew medical examinations and medical equipment replacement; operations and operating processes are also continuously monitored. |

IT risks |

Risks of incurring losses from the use of information technologies by the Company |

Relations with IT vendors and developers have been established, channel redundancy and data backup procedures are implemented, skilled personnel are recruited and trained, and the causes of IT failures are investigated. |

HR risks |

A group of risks that arise from, or affect, the Group’s personnel (or an individual employee), including the lack of required/appropriate number of employees as determined based on the current and forward-looking business plans and existing business processes |

An effective recruitment process has been put in place, and training and professional development courses for employees are organised. Also, staff pay levels are monitored in order to remain in line with the market, and a range of social benefits and guarantees is offered to employees. |

Quality risks related to purchased spare parts, units, components, and materials |

Risks of losses due to quality and authenticity (originality) of spare parts and units purchased by Aeroflot Group, as well as components and materials to support its core business |

Quality of supplies and suppliers’ operations is monitored and analysed, and procurement and supplier selection procedures are improved. |

Economic and information security risks |

Risks of losses related to changes in the corporate internal and external environment that may lead to the relevant item losing its economic value |

An effective, consistent framework has been put in place to monitor, identify, localise and prevent threats and vulnerabilities has been put in place, and steps are taken on an ongoing basis to monitor employee compliance with economic and information security requirements, and to identify and prevent breaches. |

Occupational safety risks |

Risks of incurring losses from factors related to the Group’s financial and business activities, which may cause workplace injury or death of employees |

Local occupational health regulations have been developed; compliance with, and conformity to, applicable laws are monitored. |

Tax risks |

Risks of incurring losses from possible misinterpretation of laws with respect to financial and business activities resulting in financial uncertainties of such activities after tax |

To prevent non-compliance with tax laws, changes in tax laws are regularly monitored in Russia and other countries in which the Company operates, court practice on tax disputes is analysed, contracts to be signed are analysed to remove provisions that might lead to errors or inaccuracies when taxing relevant transactions, and a regular independent audit of the applied taxation procedures is performed during annual auditing process. |

Legal and regulatory risks |

Risks of incurring losses from failure to comply with laws, changes in laws that may adversely affect financial and business activities of the Company, as well as risks of incurring losses from direct or indirect implications of potential legislative restrictions imposed by regulators on Aeroflot Group

|

In its air transport operations, Aeroflot considers local legal requirements in every destination country, as well as the requirements and recommendations of aviation regulators, along with multiple and frequent changes to the immigration policy, customs and foreign exchange laws, and licensing requirements. A range of activities is implemented to reduce the probability of adverse impacts on the continuity of Aeroflot’s air transportation operations, including legal monitoring, summarising, and analysing court practice, and monitoring of practice for signing and performing under contracts and agreements with counterparties. Aeroflot is actively involved in government and international organisations, and in drafting regulations that may impact the way the air transportation industry is regulated. |

Corruption risks |

Potential corruption offences by employees |

Aeroflot Group does not tolerate any form of corruption, is committed to the principles of transparency, openness, and fairness in its business and procurement activities, and rejects illicit benefits. Aeroflot continuously improves its corporate regulations, develops and introduces new rules and procedures to prevent corruption offences, raises awareness among employees and educates them on anti-corruption practices, and has in place effective feedback channels. In 2014, PJSC Aeroflot joined the Anti-Corruption Charter of Russian Business, and actively promotes anti-corruption activities under the Charter. Aeroflot Group has in place the corporate Anti‑Corruption Policy and the Anti-Corruption and Conflict of Interest Commission. |

Impact of key financial risks realised in 2018

Aeroflot Group’s key financial risks are associated with exchange rate fluctuations (EUR/RUB, USD/RUB, EUR/USD), jet fuel price (in Russia and abroad), and market interest rates (primarily LIBOR). These risk factors are interlinked, particularly changes in the EUR/RUB and USD/ RUB exchange rates and jet fuel prices affected by oil prices.

Significant changes in the above risk factors had a major impact on the Group’s performance in 2018 primarily due to sharp changes in foreign exchange rates and fuel prices.

In 2018, the rouble average exchange rate declined by 7.5% year-on-year against the US dollar. The rouble depreciated by 12.2% against the euro while the average EUR/USD exchange rate changed by 4.4%. These factors put pressure on Aeroflot’s FX-denominated expenses, but changes in the USD/EUR exchange rate had a positive impact on the Company with its FX revenues mostly denominated in EUR, and foreign currency expenses mostly denominated in USD.

Global oil prices grew strongly in 2018, with the price of Brent crude going up 31.0% year-on- year on average. Given the rouble depreciation, rouble oil prices grew by 41.2%, pushing the Group’s jet fuel costs up by 36.1%.

* Net of FX effect.

** The breakdown of fuel price growth into the actual price component and the foreign exchange components is based on changes in the USD price of jet fuel and changes

in the RUB/USD exchange rate.

Note. Management accounts and Company estimates.

Currency and price risks

Aeroflot Group’s exposure to currency risk results from the vast share of the Company’s income and expenses being affected by changes in the EUR/RUB and USD/RUB exchange rates:

- Sales revenue from international flight tickets is collected in foreign currency (in foreign markets or from transfer passengers), or in roubles based on euro prices, with fares across the Group’s core markets priced mostly in euros

- Fuel costs, lease payments, and maintenance costs (key foreign currency expenses accounting for 30.7%, 15.0%, and 7.7% of the Group’s operating costs, respectively) are mostly denominated in US dollars. An important foreign currency expense item for the Group is payments at foreign airports made in the currency in which local rates are priced, including euro

Our currency risk management primarily focuses on reducing the Group’s exposure to currency risk factors. Aeroflot Group pursues a policy of balancing out revenues and liabilities in each currency.

Aeroflot Group’s price risk arises from fuel purchase contracts, as the contractual pricing formula is linked to global oil prices. The Group traditionally uses hedging instruments to manage price risks. In 2016–2018, no such transactions were executed, and no risks for 2019 were hedged as at 31 December 2018.

Source: Bloomberg.

Source: Bloomberg.

Interest rate risk

The Group’s exposure to interest rate risk results from changes in the debt market interest rates affecting the costs of borrowings and loans, and driving operating lease costs escalation. Specifically, costs under lease agreements of Aeroflot Group are linked to 6M and 3M LIBOR market interest rates. In 2018, the 6M rate went up from 1.84% to 2.88%, while the 3M rate increased from 1.70% to 2.81% year-on-year (as at 31 December).

The interest risk has a limited impact on the Group given its good balance between fixed and floating rate debt.

Source: Bloomberg.

Operational risks (core and ancillary business)

Aeroflot Group uses insurance as an effective tool to manage risks. Aeroflot Group’s underlying approach is to take out, whenever practically possible, full insurance coverage for all types of risks.

The Group’s key operational risks are insured, with coverage for aviation risks, such as actual or constructive total loss, disappearance or damage of aircraft, its components and/or units, risks of airline/operator liability for injury, death, or property damage to passengers or third parties, and war risks accounting for 60% of the total insurance costs.

Aeroflot Group also uses various insurance programmes covering a wide range of non-aviation operational risks of support operations, including all types of compulsory and most types of voluntary civil liability insurance, motor insurance, property insurance (real estate, flight simulators, IT equipment), personal insurance (voluntary medical insurance for employees, their families, and retired employees of Aeroflot Group, accident insurance, disability insurance for flight crews, and travel insurance).

In 2018, all insurance contracts were renewed as scheduled. Given that all insurance policies are purchased as part of the consolidated procurement process, insurance coverage was expanded for the Group companies and insurance rates and premiums were reduced for many types of policies.

As part of its efforts to provide insurance protection, PJSC Aeroflot signed an agreement for liability insurance of PJSC Aeroflot, its directors and officers with a liability limit of USD 100 million.

Plans for 2019

Aeroflot group consistently improves its corporate risk management. In 2019, we are planning to further enhance the performance of our CRMS, including through ongoing monitoring of its performance against a system of key risk indicators, and by training Aeroflot Group’s employees in risk management