Corporate Governance System

Corporate governance framework and enhancement in 2017

PJSC Aeroflot recognises its high corporate, public, and social responsibility and undertakes to comply with high corporate governance standards set by Russian and international best practices to improve its sustainability and performance.

PJSC Aeroflot’s corporate governance is based on the following core principles formalised by the Corporate Governance Code of PJSC Aeroflot:

- Ensuring the exercise and protection of shareholder rights

- Ensuring fair and equitable treatment of all shareholders in exercising their rights

- Preventing shareholders from abusing their rights, inflicting damage to the Company and other shareholders

- Efficient distribution of roles and powers among the Company’s governing bodies

- Expertise, responsibility, and accountability of the Board of Directors and executive bodies

- Establishing an efficient internal control and risk management system

- Ensuring transparency and openness of the Company’s business

- Taking material corporate actions on fair terms ensuring that the rights and interests of shareholders and other stakeholders are upheld

- Compliance with ethical norms and social responsibility standards when doing business

To enhance its corporate governance, PJSC Aeroflot has developed and approved a roadmap to implement expert recommendations from the nonprofit partnership, Russian Institute of Directors.

PJSC Aeroflot scored 7++ on the National Corporate Governance Rating scale, according to the 2017 assessment performed as part of the annual corporate governance practice monitoring, an improvement vs the 2016 (7+) and 2015 (7) ratings.

The rating indicates that PJSC Aeroflot complies with Russian corporate governance regulations and quite a few recommendations set out in the Corporate Governance Code recommended by the Bank of Russia. Shareholders of the Company have low exposure to the risk of loss due to the corporate governance quality.

PJSC Aeroflot made a big effort to significantly improve its corporate governance and comply with recommendations of the Russian Corporate Governance Code in 2017. In September 2017, Aeroflot-Finance, a subsidiary of PJSC Aeroflot, sold 4.84% of PJSC Aeroflot shares (quasi‑treasury stock) enabling compliance with one of the material recommendations of the Corporate Governance Code not to vote with quasi-treasury shares.

Compliance with the Russian Corporate Governance Code

| Code section | Principles

recommended by the Code |

Complied with | Not fully complied with | Not complied with |

| Shareholder Rights | 13 | 11 | 2 | – |

| Board of Directors | 36 | 29 | 3 | 4 |

| Corporate Secretary | 2 | 2 | – | – |

| Remuneration System | 10 | 9 | 1 | – |

| Risk Management System | 6 | 6 | – | – |

| Information Disclosure | 7 | 7 | – | – |

| Material Corporate Actions | 5 | 4 | 1 | – |

| Total | 79 | 68 | 7 | 4 |

Note. Statistics are based on the Corporate Governance Code Compliance Report (Appendix to this Annual Report).

The Corporate Governance Code of PJSC Aeroflot was adopted in 2017 as part of implementation of the Russian Corporate Governance Code recommendations and formalises PJSC Aeroflot’s commitment to high corporate governance standards and their further improvement. Major efforts were also made to enhance Aeroflot Group’s integrated risk management system.

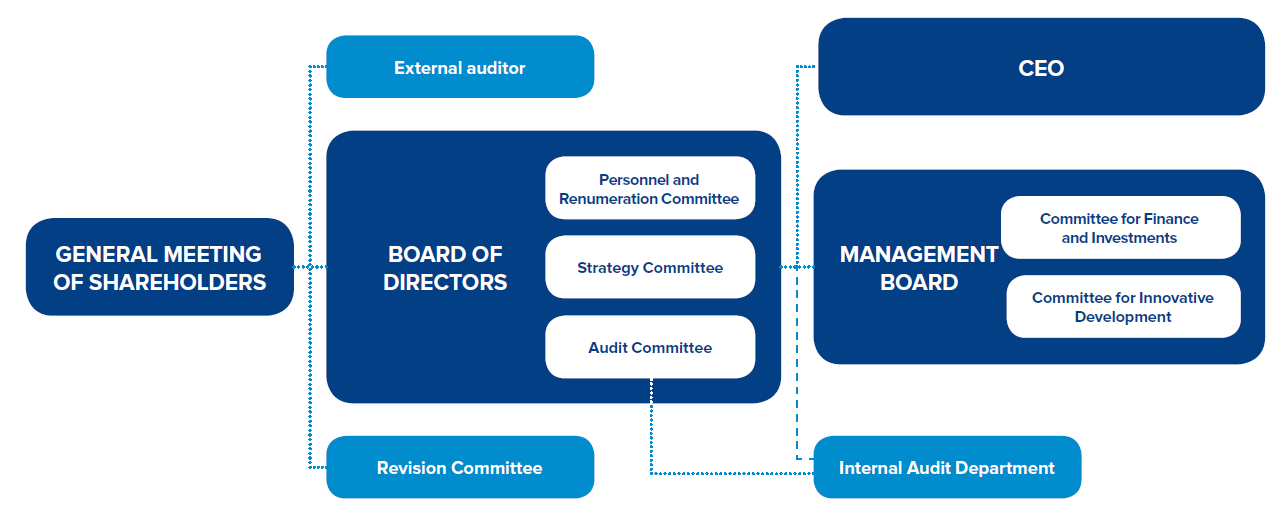

Corporate governance at PJSC Aeroflot is exercised by the General Meeting of Shareholders, the Board of Directors, the Management Board, and the CEO.

The responsibilities of PJSC Aeroflot’s Corporate Secretary are vested with the Executive Secretary of the Board of Directors, also holding the position of Director of PJSC Aeroflot’s Corporate Governance Department.

The Revision Committee supervises the Company’s financial and business operations, its units and services. PJSC Aeroflot’s financial and operational activities are also audited in accordance with both the Russian Accounting Standards (RAS) and the International Financial Reporting Standards (IFRS) by external auditors and the Internal Audit Department accountable to the Audit Committee of PJSC Aeroflot’s Board of Directors.

Key documents ensuring protection of PJSC Aeroflot shareholder rights include:

- Articles of Association

- Regulations on the General Meeting of Shareholders

- Regulations on the Board of Directors

- Regulations on the Management Board

- Regulations on the Revision Committee

- Corporate Governance Code

- Regulations on the Corporate Information Policy

- Dividend Policy

- Corporate Conduct Code

PJSC Aeroflot controls interests in (holds shares in the charter capital of) a number of subsidiaries, including airlines, where PJSC Aeroflot also ensures compliance with the top standards of corporate governance by development and implementation of Group-wide policies and principles. The Company developed a cross-functional governance system for its aviation subsidiaries.

To ensure supervision over financial and business activities of its subsidiary airlines, the Group enabled each of them to have a dedicated revision committee made up of PJSC Aeroflot’s representatives. In addition to revision committee inspections, the airlines are subject to inspections by an auditor approved pursuant to the relevant bidding procedures.

In accordance with the applicable laws and their articles of association, each subsidiary airline developed and adopted dedicated internal documents stipulating the responsibilities of its governing bodies.

PJSC Aeroflot controls interests in (holds shares in the charter capital of) a number of subsidiaries, including airlines, where PJSC Aeroflot also ensures compliance with the top standards of corporate governance by development and implementation of Groupwide policies and principles. The Company developed a cross-functional governance system for its aviation subsidiaries.

To ensure supervision over financial and business activities of its subsidiary airlines, the Group enabled each of them to have a dedicated revision committee made up of PJSC Aeroflot’s representatives. In addition to revision committee inspections, the airlines are subject to inspections by an auditor approved pursuant to the relevant bidding procedures.

In accordance with the applicable laws and their articles of association, each subsidiary airline developed and adopted dedicated internal documents stipulating the responsibilities of its governing bodies.

General meeting of shareholders

The General Meeting of Shareholders is

the Company’s supreme governing body.

The respective scope of authority and

procedures for convening, holding, and

summarising Annual General Meetings of

Shareholders (AGMs) are set forth in the

Company’s Articles of Association and

Regulations on the General Meeting of

Shareholders. The Annual General Meeting of

Shareholders is held annually no earlier than

three months and no later than six months after

the end of the fiscal year.

Annual General Meeting of Shareholders on 26 June 2017

In 2017, PJSC Aeroflot convened the Annual General Meeting of Shareholders in Moscow on 26 June (Minutes No. 40 dated 28 June 2017). The meeting was attended by holders of 74.1% of PJSC Aeroflot’s share capital. The Annual General Meeting of Shareholders approved the Company’s Annual Report, 2016 financial statements (including the profit and loss statement), the Board’s recommendations on the distribution of the net profit for FY2016, and the remunerations of the members of the Board of Directors and the Revision Committee, as recommended by the Board of Directors.

New Board of Directors and Revision Committee were elected. Pursuant to the relevant bidding procedures, the Company selected an auditor for 2018 (to audit the Company’s statements prepared under the Russian Accounting Standards (RAS) and the International Financial Reporting Standards (IFRS)). It also adopted new versions of PJSC Aeroflot’s Articles of Association, Regulations on the General Meeting of Shareholders, Regulations on the Board of Directors, Regulations on the Management Board, and Regulations on Remuneration and Compensation Payments to the Members of the Board of Directors of PJSC Aeroflot. The Company also endorsed a number of interested party transactions.

The Annual General Meeting of Shareholders of PJSC Aeroflot approved a dividend of RUB 17.4795 per ordinary share for FY2016, with total dividend payments of RUB 19,413,018,000. This resolution took into account the recommendations of the Board of Directors and was passed in line with PJSC Aeroflot’s Dividend Policy, which stipulates that Aeroflot Group’s net profit (under IFRS) forms the base for calculating dividends.

Extraordinary General Meeting of Shareholders on 26 December 2017

The Extraordinary General Meeting (EGM) of Shareholders held on 26 December 2017 (Minutes No. 41 dated 27 December 2017) was attended by holders of 63.6% of PJSC Aeroflot’s share capital.

The EGM approved the interested party transaction (several associated transactions) related to the lease of 20 new regional jets Sukhoi Superjet 100 between PJSC Aeroflot, VEB-leasing, and Sukhoi Civil Aircraft, as well as a major interested party transaction related to the commercial management of flight loads for services operated by Rossiya Airlines (including pricing and ticket sales for such flights) under the agreements for joint flight operation (code share / blocked space).

Board of Directors

PJSC Aeroflot’s Board of Directors has overall supervising authority over the Company. The Board of Directors is responsible for the Company’s operations, excluding matters within the authority of PJSC Aeroflot’s General Meeting of Shareholders, Management Board, and Chief Executive Officer. The procedures for convening and holding the Board meetings, along with other Board activities, are stipulated by the Regulations on PJSC Aeroflot’s Board of Directors in line with the Federal Law On Joint‑Stock Companies.

The Board’s key focus areas include the Company’s long-term sustainable development, effective oversight of its executive bodies, uncompromising observance and protection of shareholder rights and their legitimate interests. The main objectives of the Board of Directors are to:

- define the core areas of business for the Company (including subsidiary airlines) to increase its operating profit

- operate for the benefit of shareholders, supervise the implementation of corporate initiatives

- supervise the activities of the Company’s Management Board and Chief Executive Officer

- present resolutions on matters within the authority of the General Meeting of Shareholders for approval by shareholders

- discuss and approve business plans

- determine the procedure for distributing profit and covering for loss

- develop the Company’s dividend policy, work out proposals on the amount of dividend on Company shares and dividend payout procedure, and present them for approval by the General Meeting of Shareholders

- approve the annual budget and monitor its performance

- discuss and pre-approve draft annual reports, annual accounting statements, and profit and loss accounts

- analyse audit reports and opinions of the Revision Committee, and present documents featuring the results of such audits for consideration by the Company’s shareholders

- present proposals to the General Meeting of Shareholders on the appointment of the Company’s auditor

- determine the policy on issuing the Company’s securities

- approve the Company’s special registrar and the terms and conditions of the contract therewith, as well as the contract termination.

In line with the action plan for the Board of Directors, the Board meetings are held at least once a month. The action plan for the Board of Directors is approved at the end of the year preceding the year covered in the plan. As a rule, the action plan includes essential matters concerning the Company’s operations (strategy, finance, budget and risks, human resources, etc.), which are to be discussed in line with the strategic and business planning cycle. Proposals made by members of the Board of Directors and the Company’s management are factored in. Extraordinary meetings may be convened to make decisions on urgent matters.

The agenda of the Board of Directors’ meetings must include items proposed for discussion by shareholders who in aggregate hold at least 2% of shares, members of the Board of Directors, the Revision Committee, the Management Board, the Company’s auditor, and by the CEO.

All items on the agenda of the Board of Directors’ meetings are generally previewed by dedicated committees to enable a more detailed discussion and prepare recommendations for voting to the Board of Directors.

The Board of Directors’ meetings held in absentia consider matters on which members of the Board of Directors do not have any material comments, as well as matters of procedure. However, a matter may be moved to the agenda of a meeting held in person upon request of two members of the Board of Directors.

Chairman of the Board of Directors

- is responsible for the general stewardship of the Board of Directors, convenes and chairs meetings, arranges for keeping the minutes of meetings, chairs the General Meeting of Shareholders

- helps ensure the timely provision to members of the Board of Directors of all the information required to pass resolutions and vote on agenda items

- ensures productive discussion of agenda items involving non-executive and independent directors

- controls the execution of resolutions passed by the Board of Directors and the General Meeting of Shareholders.

Independent directors

Independent directors promote opinions and judgements unaffected by relations with the Company’s shareholders or executive bodies, as well as decision-making which benefits different shareholder groups.

The presence of independent directors enhances corporate governance in the Company. Independent members of the Board of Directors are actively involved in the activities of the Board committees. In accordance with the requirements of the Moscow Exchange, independent directors head the Board of Directors’ Audit Committee and Personnel and Remuneration Committee. The majority of members of the Board of Directors’ Committees are also independent directors, which helps achieve a balanced and independent position on agenda items.

Membership of the Board of Directors

As at 31 December 2017, PJSC Aeroflot’s Board of Directors was comprised of the Chairman (non-executive director), two executive directors, four non-executive directors, and four independent directors.

Members of the Board of Directors efficiently performed their functions and tasks notwithstanding their service on boards of directors at other companies.

In the reporting year, no members of the Company’s Board of Directors purchased or disposed of their shares in the Company.

In 2017, no claims were filed against members of the Board of Directors.

All Members Audit

Committee Personnel and

Remuneration Committee Strategy

Committee

Mikhail Poluboyarinov

Chairman of the Board of Directors, Non-Executive Director

Since 2009, Director of the Infrastructure Department and Deputy Chairman of Vnesheconombank, First Deputy Chairman of Vnesheconombank.

Member of PJSC Aeroflot’s Board of Directors since 2017.

Born on 2 April 1966 in Moscow.

In 1988, graduated from Moscow Financial University with a degree in Finance and Credit. In 1998, graduated from the Plekhanov Russian University of Economics with a PhD in Economics majoring in Finance, Currency Circulation and Credit.

He is currently member of the board of directors at Rosseti, Leader, Rostelecom, and FGC UES, and a member of the supervisory board at AHML.

From 2000 to 2009, Chief Accountant and Deputy CEO of PJSC Aeroflot.

From 1990 to 1999, Chief Accountant and Financial Director of Avtoimport.

He has been awarded the title of the Honoured Economist of Russia and a Letter of Acknowledgement from the Ministry of Transport of the Russian Federation. For his contribution to the preparation of the XXII Winter Olympic Games and the XI Winter Paralympic Games in Sochi in 2014, Mikhail Poluboyarinov was awarded the Order of Honour.

NO SHAREHOLDING IN PJSC AEROFLOT.

Vitaly Saveliev

Executive Director

Since 10 April 2009, CEO of PJSC Aeroflot.

Member of PJSC Aeroflot’s Board of Directors since 2009.

Born on 18 January 1954 in Tashkent. In 1977, graduated from Kalinin Leningrad Polytechnic Institute (St Petersburg Polytechnic University). In 1986, graduated from the Leningrad Institute of Engineering and Economics (the St Petersburg State University of Economics). Did an internship abroad. PhD in Economics.

From 1977 to 1984, was engaged in the construction of the Sayano–Shushenskaya HPP where he worked his way up from an engineer to the general designer in one of Krasnoyarskgesstroi associations.

From 1984 to 1987, Deputy Director of All-Union Sevzapmetallurgmontazh Trust.

From 1987 to 1989, Deputy Head of Chief Directorate at Glavleningradinzhstroi.

From 1989 to 1993, President of the US-Russian joint venture DialogInvest.

From 1993 to 1995, Chairman of the Management Board at Rossiya Bank.

From 1995 to 2001, Chairman of the Management Board at Menatep Saint Petersburg.

From 2001 to 2002, Deputy Chairman of the Management Board at Gazprom.

From 2004 to 2007, Deputy Minister for Economic Development and Trade of the Russian Federation.

From 2007 to 2009, First Vice-President of Sistema Financial Corporation.

Since 10 April 2009, CEO of PJSC Aeroflot.

At different periods, Mr Saveliev served as chairman of the boards of directors at All-Russian Exhibition Centre (VVC), the Russian Bank for Development, MTS, Comstar, SMM, SkyLink, Indian Shyam Telelink, and other companies.

Recipient of the Order “For Merit to the Fatherland”, 4th class, the Order of Honour, the Order of Friendship; he was awarded a Letter of Acknowledgement from the President of the Russian Federation, numerous medals of the Russian Federation, and industry awards.

HAS A 0.121% SHAREHOLDING IN PJSC AEROFLOT.

Mikhail Voevodin

Non-Executive Director

Member of the Strategy Committee and the Personnel and Remuneration Committee of the Board of Directors

Since July 2009, CEO of VSMPO-AVISMA Corporation.

Member of PJSC Aeroflot’s Board of Directors since 2017.

Born on 3 May 1975 in Moscow.

In 1996, graduated from the Plekhanov Russian University of Economics with a degree in Economic Cybernetics. In 2001, graduated from the Diplomatic Academy of the Ministry of Foreign Affairs of the Russian Federation with a degree in World Economy and International Economic Relations.

Since March 2009 to July 2009, President of VSMPO-AVISMA Corporation.

Since 2006, member of the Bboard of Directors at VSMPO-AVISMA Corporation.

In 2005, he was appointed First Deputy CEO – Executive Director of Prominvest.

Since 2002, he held various managerial positions at Prominvest, an investment company within Rostec Corporation.

NO SHAREHOLDING IN PJSC AEROFLOT.

Alexey Germanovich

Independent Director

Head of the Personnel and Remuneration Committee, member of the Audit Committee and the Strategy Committee of the Board of Directors

Currently, independent director on the boards of directors at Unipro (formerly, E.On Russia), Bank St Petersburg, and Ameriabank (Armenia).

From 2012 to 2014, member of PJSC Aeroflot’s Board of Directors. In 2016, re-elected to PJSC Aeroflot’s Board of Directors.

In 1998, graduated from the Department of Economics, and in 2002, from the Department of Journalism at Lomonosov Moscow State University; in 2008, graduated from Cranfield University, UK (Executive MBA).

Chairman of the Corporate Governance Committee at the Expert and Advisory Council of the Federal Agency for State Property Management.

From 2012 to 2014, Director, member of the Management Board, and advisor to the Russian Direct Investment Fund.

From 2009 to 2012, director of social and public programmes, professor of practice at Moscow SKOLKOVO Management School.

From 2002 to 2009, member of the Management Board and Deputy CEO of Severstal Group.

At different periods, served on boards of directors at a variety of Russian transport companies, such as Siberia Airlines, Irkutsk International Airport, Rossiya State Transport Company, SG-Trans, etc. For the past five years, was named among Russia’s 50 best independent directors in the rating compiled by the Russian Union of Industrialists and Entrepreneurs in cooperation with PwC and the IDA.

NO SHAREHOLDING IN PJSC AEROFLOT.

Igor Kamenskoy

Independent Director

Head of the Strategy Committee, member of the Audit Committee and the Personnel and Remuneration Committee of the Board of Directors

Since 2015, Managing Director of Renaissance Broker.

Member of PJSC Aeroflot’s Board of Directors since 2014.

Born on 25 January 1968 in Kiev.

In 1993, graduated from Moscow State Pedagogical Institute with a degree in Russian Language and Literature.

From 2014 to 2015, Managing Partner of Renaissance Capital – Financial Consultant.

From 2009 to 2014, Chairman of the Board of Directors at Renaissance Capital.

From 2002 to 2009, member of the Federation Council, Deputy Chairman of the Federation Council Committee.

From 2000 to 2002, Advisor to the Chairman of the State Duma.

In 1999, Vice-President of Rosbank.

From 1992 to 1998, Vice-President of Soyuzcontract.

NO SHAREHOLDING IN PJSC AEROFLOT.

Lars Erik Anders Bergstrom

Independent Director

Member of the Audit Committee and the Personnel and Remuneration Committee of the Board of Directors

Since 2016, Senior Advisor at UB Capital (United Bankers of Finland).

Member of PJSC Aeroflot’s Board of Directors since 2017.

Born on 16 October 1965 in Uppsala, Sweden.

From 1988 to 1992, studied in the Stockholm School of Economics and Business Administration majoring in Finance and Eastern European Studies.

Since 2013, founder and manager of his own advisory and investment company, Montecito Capital.

From 2006 to 2013, Managing Director, Head of Russia/CIS at Carnegie Investment Bank, Stockholm, Sweden.

From 2000 to 2005, private equity investor and founder of TrustLink, a software vendor with offices in Moscow, Stockholm, and San Mateo, California.

From 1998 to 2000, CEO of SEB Enskilda Securities Corporate Finance, Moscow, Russia.

From 1995 to 1998, CEO of ABN Amro (Equities) Russia for emerging markets development.

In 1994, Harvard University Officer, Advisor, and board member at the Russian Privatization Center of the Russian Property Committee, Goskomimushchestvo, Moscow, where he managed restructuring of privatized Russian corporations.

In 1993, Advisor to the Ministry of Finance of the Russian Federation, Deputy Director of the Monetary and Finance Unit, Moscow.

In 1992, First Secretary at the Ministry of Foreign Affairs in Stockholm, Sweden, Head of the Russian Desk.

In 1991, Vice-Consul, Consulate General of Sweden in Leningrad and Riga, the USSR.

NO SHAREHOLDING IN PJSC AEROFLOT.

Dmitry Peskov

Non-Executive Director

Member of the Personnel and Remuneration Committee and the Strategy Committee of the Board of Directors

Since 2011, Director of Young Professionals at the Agency for Strategic Initiatives.

Member of PJSC Aeroflot’s Board of Directors since 2014.

Born on 26 December 1975 in Voronezh.

Graduated from Voronezh State University in 1998. In 1999, obtained a Master’s degree in Political Studies from the Moscow School of Social and Economic Sciences and the University of Manchester.

Member of the Government Expert Council, member of the Board of Directors at RVC.

Since 2009, Head of Strategic Initiatives at All-Russian Exhibition Centre.

Since 2000, has led the strategy development exercise, chaired the Internet Policy Centre, and overseen the establishment of the Russian International Studies Association at the Moscow State Institute of International Relations (MGIMO University). Last position held – Deputy Scientific Vice-President, Innovation Director.

NO SHAREHOLDING IN PJSC AEROFLOT.

Dmitry Saprykin

Executive Director

Member of the Strategy Committee of the Board of Directors

Since November 2015, CEO of Rossiya Airlines.

Member of PJSC Aeroflot’s Board of Directors since 2011.

Born in 1974 in Moscow.

In 1996, graduated from Moscow State Law Academy with a degree in Law. Obtained a PhD in Law in 2000. In 2001, graduated from Cornell Law School.

From 2013 to 2015, Deputy CEO for Sales and Property Issues at PJSC Aeroflot.

From 2009 to 2013, Deputy CEO for Legal and Property Issues at PJSC Aeroflot.

From 2007 to 2009, Director of Transaction Support, Deputy Head of the Legal Division at Sistema Financial Corporation.

From 2006 to 2007, CEO of Moscow Cellular Communications.

From 2004 to 2006, Deputy CEO for Corporate Affairs and Finance at SkyLink.

From 2001 to 2004, Division Head and Director of M&A and Capital Markets Department at MTS.

From 1996 to 1998, Chief Legal Adviser at Bank Menatep.

NO SHAREHOLDING IN PJSC AEROFLOT.

Vasily Sidorov

Independent Director

Head of the Audit Committee, member of the Personnel and Remuneration Committee, and the Strategy Committee of the Board of Directors

Since November 2012, CEO of Arida.

Member of PJSC Aeroflot’s Board of Directors since 2013.

Born on 2 February 1971 in Athens, Greece.

In 1993, graduated from the Moscow State Institute of International Relations (MGIMO University) with a degree in International Public Law, and from the Wharton Business School of the University of Pennsylvania with a degree in Finance.

Since June 2012, member of the Board of Directors at Russian Railways.

From 2010 to 2017, Managing Partner of Euroatlantic Investments Ltd.

From 2006 to 2010, co-owner of Telecom Express Group.

From 2003 to 2006, President of MTS.

From 2000 to 2003, First Vice-President of Sistema Telecom.

From 1997 to 2000, Deputy CEO of Svyazinvest.

NO SHAREHOLDING IN PJSC AEROFLOT.

Yury Slyusar

Non-Executive Director

Member of the Strategy Committee of the Board of Directors

Since January 2015, President of United Aircraft Corporation.

Member of PJSC Aeroflot’s Board of Directors since 2015.

Born on 20 July 1974 in Rostov-on-Don.

In 1996, graduated from Lomonosov Moscow State University with a degree in Law. In 2003, completed a post-graduate programme at the Academy of National Economy under the Government of the Russian Federation. PhD in Economics.

In 2012, was appointed Deputy Minister of Industry and Trade of the Russian Federation.

In 2010, Director of the Aviation Industry Department at the Ministry of Industry and Trade of the Russian Federation.

In 2009, was appointed Assistant to the Minister of Industry and Trade of the Russian Federation.

Since 2003, Commercial Director of Rostvertol, Rostov-on-Don.

Until 2003, worked with various business entities.

NO SHAREHOLDING IN PJSC AEROFLOT.

Sergey Chemezov

Non-Executive Director

Since December 2007, CEO of Rostec State Corporation.

Member of PJSC Aeroflot’s Board of Directors since 2011.

Born on 20 August 1952 in Cheremkhovo, the Irkutsk Region.

Graduated from the Irkutsk Institute of National Economy, completed Advanced Courses at the Military Academy of the General Staff of the Russian Armed Forces. Doctor of Economics, Professor, full member of the Academy of Military Science.

Chairman of the boards of directors at Rosoboronexport, VSMPO-AVISMA Corporation, Kamaz, and Uralkali.

Member of the boards of directors at International Financial Club, and Alliance Rostec AUTO BV Joint Venture. Member of the supervisory boards at Rostec, and Roscosmos State Corporations.

From 2004 to 2007, CEO of Rosoboronexport.

From 2001 to 2004, First Deputy CEO of Rosoboronexport.

From 1999 to 2001, CEO of Promexport.

From 1996 to 1999, Head of Foreign Economic Relations at the Administrative Office of the Russian President.

From 1988 to 1996, Deputy CEO of Sovintersport.

Since 1980, worked at the Luch Research-Industrial Association; from 1983 to 1988, served as Head of the Luch Association representative office in East Germany.

Started his career at Irkutsk Scientific and Research Institute for Rare and Non-Ferrous Metals.

Member of the Bureau of the Supreme Council of the United Russia Party. Chairman of the Russian Engineering Union. President of the Russian Union of Engineering Employers. Head of the Department of Military and Engineering Cooperation and High-Tech at the Moscow State Institute of International Relations (MGIMO University).

Recipient of high government awards and winner of a large number of other prestigious awards.

NO SHAREHOLDING IN PJSC AEROFLOT.

Executive Secretary of the Board of Directors

ALEKSEY MELEKHIN

Born in 1977. In 2001, graduated from the Institute of Economics and Entrepreneurship. Obtained a PhD from the Russian

Presidential Academy of National Economy and Public Administration. Mr Melekhin joined PJSC Aeroflot in 1998. Held a

number of positions from legal counsel to regulations drafting and alignment team of the Company’s Administration to

Corporate Governance Department Director.

He is currently responsible for the administrative and information support of the Company’s Board of Directors and General

Meeting of Shareholders, and supervises compliance by the Company’s bodies and officers with corporate governance

rules and procedures stipulated by the laws of the Russian Federation, the Company’s Articles of Association, and internal

documents.

NO SHAREHOLDING IN PJSC AEROFLOT.

As at 31 December 2017, PJSC Aeroflot’s Board of Directors was comprised of the Chairman (non-executive director), two executive directors, four non-executive directors, and four independent directors.

Members of the Board of Directors efficiently performed their functions and tasks notwithstanding their service on boards of directors at other companies.

In the reporting year, no members of the Company’s Board of Directors purchased or disposed of their shares in the Company.

In 2017, no claims were filed against members of the Board of Directors.

Changes in the membership of the Board of Directors in 2017

- Kirill Androsov was removed from the Board of Directors as from 26 June 2017 by resolution of the Annual General Meeting of Shareholders (Minutes No. 40 dated 28 June 2017).

- Roman Pakhomov was removed from the Board of Directors as from 26 June 2017 by resolution of the Annual General Meeting of Shareholders (Minutes No. 40 dated 28 June 2017).

- Mikhail Alekseev was removed from the Board of Directors as from 26 June 2017 by resolution of the Annual General Meeting of Shareholders (Minutes No. 40 dated 28 June 2017).

- Mikhail Poluboyarinov was elected to the Board of Directors as from 26 June 2017 by resolution of the Annual General Meeting of Shareholders (Minutes No. 40 dated 28 June 2017).

- Lars Bergstrom was elected to the Board of Directors as from 26 June 2017 by resolution of the Annual General Meeting of Shareholders (Minutes No. 40 dated 28 June 2017).

- Mikhail Voevodin was elected to the Board of Directors as from 26 June 2017 by resolution of the Annual General Meeting of Shareholders (Minutes No. 40 dated 28 June 2017).

Other members of the Board of Directors were re-elected at the 2017 AGM. Mikhail Poluboyarinov, First Deputy Chairman and a member of the Management Board of State Corporation Bank for Development and Foreign Economic Affairs (Vnesheconombank), was elected as the new Chairman of the Board of Directors at the meeting of the Board held on 31 August 2017.

Board of Directors Performance Report for 2017

In 2017, PJSC Aeroflot’s Board of Directors held 16 meetings, including 9 meetings in person and 7 meetings in absentia, which addressed over 150 matters and passed over 330 resolutions.

In its resolutions, the Board of Directors covers a number of priority areas to:

- ensure flight safety and on-time performance

- determine Aeroflot Group’s strategy and identify priority business segments

- build and maintain effective internal controls and risk management

- map out a development strategy for Aeroflot Group’s aircraft fleet and route network

- improve the aircraft fleet composition through additions and aircraft mix optimisation

- improve operating, financial, and marketing practices and methods through upgrades, innovation, and implementation of best practices from global peers

- improve the performance of Aeroflot’s branches and representative offices both domestically and internationally

- enforce higher standards for airport and in-flight passenger services, expand the service mix, and improve customer experience

- promote cooperation with SkyTeam partners, use the membership to expand the Company’s route network, and boost the international flight performance

- promote strategic partnerships with airlines across key geographies

- improve operational performance of subsidiaries and streamline the non-core asset structure to cut unnecessary spending and increase returns on investments

- develop and upgrade information technologies

- ensure information transparency (including investor relations and procurement)

- develop and improve corporate policies.

Directors attendance at Board meetings in 2017

Board member |

Status |

Board of Directors |

Audit Committee |

Personnel and Remuneration Committee |

Strategy Committee |

Mikhail Alekseev* |

Non-Executive Director |

9(5)/9 |

5(3)/5 |

||

Kirill Androsov* |

Chairman of the Board of Directors |

9(5)/9 |

|||

Lars Erik Bergstrom** |

Independent Director |

7(2)/7 |

5(1)/6 |

4(1)/5 |

|

Mikhail Voevodin** |

Non-Executive Director |

7(2)/7 |

4(1)/5 |

5/6 |

|

Alexey Germanovich |

Independent Director |

16(7)/16 |

12/12 |

8(1)/8 |

11/11 |

Igor Kamenskoy |

Independent Director |

16(7)/16 |

12(1)/12 |

8(2)/8 |

11(1)/11 |

Roman Pakhomov* |

Non-Executive Director |

9(5)/9 |

6/6 |

3/3 |

5/5 |

Dmitry Peskov |

Non-Executive Director |

16(9)/16 |

7(3)/8 |

10(3)/11 |

|

Mikhail Poluboyarinov** |

Chairman of the Board of Directors |

7(2)/7 |

|||

Vitaly Saveliev |

Executive Director |

16(7)/16 |

|||

Dmitry Saprykin |

Executive Director |

16(7)/16 |

10(7)/11 |

||

Vasily Sidorov |

Independent Director |

16(7)/16 |

12/12 |

8(1)/8 |

11/11 |

Yury Slyusar |

Non-Executive Director |

15(13)/16 |

11(10)/11 |

||

Sergey Chemezov |

Non-Executive Director |

16(11)/16 |

Note. Data format: the number of meetings attended by the member of the Board of Directors / the total number of meetings held in 2017. Attendance through written opinions or

questionnaires (for meetings held in absentia) is shown in brackets.

* Member of the Board of Directors as from the Annual General Meeting of Shareholders held on 26 June 2017.

** Member of the Board of Directors up to the Annual General Meeting of Shareholders held on 26 June 2017.

Key matters discussed by the Board of Directors in 2017

| STRATEGIC DEVELOPMENT |

|

| FINANCIAL AND ECONOMIC PERFORMANCE AND INVESTMENTS |

|

| CORPORATE GOVERNANCE |

|

| TRANSACTIONS |

|

| OTHER |

|

Committees of the Board of Directors

To improve the effectiveness of resolutions passed by the Board of Directors, ensure more detailed preliminary discussions of most important matters, and prepare relevant recommendations, PJSC Aeroflot has three dedicated Committees of the Board of Directors:

- Audit Committee

- Personnel and Remuneration Committee

- Strategy Committee.

The Board of Directors’ Committees are elected by the Board of Directors and act in compliance with relevant Committee Regulations approved by the Company’s Board of Directors. The Committees act as per the Board’s resolutions and action plans based on the Board’s action plan.

In 2017, the Board of Directors’ Committees held a total of 14 meetings, including joint meetings, addressing matters related to the operations of Aeroflot Group and submitting detailed recommendations and proposals to the Company’s Board of Directors and Management Board.

Audit Committee

The Audit Committee supervises the Company’s financial and business operations to protect shareholder interests and ensure the growth of the Company’s assets. Coordinating with the Company’s executive bodies, the Revision Committee, and the Internal Audit Department, the Audit Committee prepares and submits for consideration by the Board of Directors recommendations and proposals on matters of the Board.

In 2017, the Audit Committee held a total of 12 meetings (in person). The Committee’s meeting agendas were compiled in line with the Committee’s activities plan approved by the first post-election meeting, and reflected the instructions of the Board of Directors.

Key matters discussed in 2017:

- Performance of Aeroflot Group’s consolidated budget KPIs

- Aeroflot Group’s and PJSC Aeroflot’s budgets

- Controls and risk management

- Initiatives to reduce Aeroflot Group’s operating expenses

- Improvement of internal audit at Aeroflot Group

- Auditor’s reports on the financial and business audit results

- Reports on audits conducted by the Internal Audit Department

- Shareholder and investor relations

- Procurement

- Transactions related to the aircraft fleet

- Financial hedging

- Measures to mitigate the Company’s risks arising from relations with ticket sales agents

- Extending and restructuring of loans

- Reports on the results of analysis of the companies’ debt to PJSC Aeroflot

- PJSC Aeroflot’s key financial and business audit areas

- PJSC Aeroflot’s internal documents

Changes in the membership of the Audit Committee in 2017

| Committee membership from January to June 2017 | Committee membership from September to December 2017 |

| Vasily Sidorov – Independent Director, Head of the Committee |

Vasily Sidorov – Independent Director, Head of the Committee |

| Alexey Germanovich – Independent Director | Lars Erik Bergstrom – Independent Director |

| Igor Kamenskoy – Independent Director | Alexey Germanovich – Independent Director |

| Roman Pakhomov – Non-Executive Director | Igor Kamenskoy – Independent Director |

| Elected by resolution of the Board of Directors on 8 September 2016 | Elected by resolution of the Board of Directors on 31 August 2017 |

Personnel and Remuneration Committee

The Personnel and Remuneration Committee promotes the development of the HR policy, supervises matters concerning the Company’s organisational structure, selection and assessment of persons appointed to the Company’s governing bodies, their remuneration, and the remuneration system.

In 2017, the Personnel and Remuneration Committee held a total of eight meetings, including one meeting held in absentia. The Committee’s meeting agendas were compiled in line with the Committee’s activities plan approved by the first post‑election meeting, and reflected the instructions of the Board of Directors.

Key matters discussed in 2017:

- remuneration of the Company’s management, members of the Board of Directors and the Revision Committee

- long-term incentive programme

- CEO and management KPIs

- Aeroflot Group’s Long-Term Development Programme KPIs

- assessment of the Board of Directors

- the Company’s organisational structure

- consideration of proposals and preparation of recommendations on nominees to PJSC Aeroflot’s Board of Directors and Revision Committee representing the interests of the state in the corporate year 2018–2019

- PJSC Aeroflot’s internal documents.

Changes in the membership of the Personnel and Remuneration Committee in 2017

| Committee membership from January to June 2017 | Committee membership from September to December 2017 |

| Igor Kamenskoy – Independent Director, Head of the Committee |

Alexey Germanovich – Independent Director, Head of the Committee |

| Alexey Germanovich – Independent Director | Lars Erik Bergstrom – Independent Director |

| Vasily Sidorov – Independent Director | Mikhail Voevodin – Non-Executive Director |

| Roman Pakhomov – Non-Executive Director | Vasily Sidorov – Independent Director |

| Dmitry Peskov – Non-Executive Director | Igor Kamenskoy – Independent Director |

| Dmitry Peskov – Non-Executive Director | |

| Elected by resolution of the Board of Directors on 8 September 2016 | Elected by resolution of the Board of Directors on 31 August 2017 |

Strategy Committee

The Strategy Committee was set up to prepare recommendations and proposals to the Board of Directors, enhancing the Company’s performance and improving its long‑term strategy.

In 2017, the Strategy Committee held a total of 11 meetings (in person). The Committee’s meeting agendas were compiled in line with the Committee’s activities plan approved by the first post-election meeting, and reflected the instructions of the Board of Directors.

Key matters discussed in 2017:

- Implementation of Aeroflot Group’s development strategy

- Implementation of Aeroflot Group’s Long-Term Development Programme

- Implementation of Aeroflot Group’s marketing strategy

- Aeroflot Group’s development strategy and Long-Term Development Programme update

- Strategic partnerships with airlines

- Dividend policy

- Aeroflot Group’s IT strategy

- Shareholder and investor relations

- Enhancement of Aeroflot Group’s subsidiary airlines

- Enhancement of maintenance and repair operators within Aeroflot Group

- Assessment of innovative development programmes update for partially state-owned companies

- Results of PJSC Aeroflot’s Innovative Development Programme

- Aircraft fleet expansion

Changes in the membership of the Strategy Committee in 2017

| Committee membership from January to June 2017 | Committee membership from September to December 2017 |

| Roman Pakhomov – Non-Executive Director, Head of the Committee |

Igor Kamenskoy – Independent Director, Head of the Committee |

| Mikhail Alekseev – Non-Executive Director | Mikhail Voevodin – Non-Executive Director |

| Alexey Germanovich – Independent Director | Alexey Germanovich – Independent Director |

| Igor Kamenskoy – Independent Director | Dmitry Peskov – Non-Executive Director |

| Dmitry Peskov – Non-Executive Director | Dmitry Saprykin – Executive Director |

| Dmitry Saprykin – Executive Director | Vasily Sidorov – Independent Director |

| Vasily Sidorov – Independent Director | Yury Slyusar – Non-Executive Director |

| Yury Slyusar – Non-Executive Director | Giorgio Callegari – member of the Management Board, Deputy CEO for Strategy and Alliances |

| Giorgio Callegari – member of the Management Board, Deputy CEO for Strategy and Alliances | Shamil Kurmashov – member of the Management Board, Deputy CEO for Commerce and Finance |

| Shamil Kurmashov – member of the Management Board, Deputy CEO for Commerce and Finance | Roman Pakhomov – CEO of Aviacapital-Service |

| Elected by resolution of the Board of Directors on 8 September 2016 | Elected by resolution of the Board of Directors on 31 August 2017 |

Management Board and CEO

PJSC Aeroflot’s sole executive body, the CEO, and collective executive body, the Management Board, are charged with running the Company’s ongoing operations. The executive bodies report directly to the Board of Directors and the General Meeting of Shareholders.

The CEO also acts as the Chairman of the Management Board, and represents the interests of the Company without power of attorney, acting in compliance with PJSC Aeroflot’s Articles of Association. The CEO is elected by the Board of Directors for a maximum term of five years.

Vitaly Saveliev has been PJSC Aeroflot’s CEO since April 2009; in October 2013, the Board of Directors resolved to extend his term of office until 2018.

The Board of Directors is authorised to appoint members of the Management Board, and remove them from office before the end of their term. The Management Board acts in compliance with PJSC Aeroflot’s Articles of Association and Regulations on the Management Board.

PJSC Aeroflot’s executive bodies’ scope of authority covers all matters pertaining to management of the Company’s day-to-day operations, except for those referred to the jurisdiction of the General Meeting of Shareholders or the Board of Directors.

In the reporting period, members of the Management Board did not enter into transactions with PJSC Aeroflot shares.

VITALY SAVELIEV

Chairman of the Management Board, CEO

Born on 18 January 1954 in Tashkent. In 1977, graduated from Leningrad Polytechnic Institute (St Petersburg Polytechnic University). In 1986, graduated from the Leningrad Institute of Engineering and Economics (the St Petersburg State University of Economics). Did an internship abroad. PhD in Economics.

From 1977 to 1984, was engaged in the construction of the Sayano–Shushenskaya HPP where he worked his way up from an engineer to the general designer in one of the Krasnoyarskgesstroi associations.

From 1984 to 1987, Deputy Director of All-Union Sevzapmetallurgmontazh Trust.

From 1987 to 1989, Deputy Head of Chief Directorate at Glavleningradinzhstroi.

From 1989 to 1993, President of the US-Russian joint venture DialogInvest.

From 1993 to 1995, Chairman of the Management Board at Rossiya Bank.

From 1995 to 2001, Chairman of the Management Board at Menatep Saint Petersburg.

From 2001 to 2002, Deputy Chairman of the Management Board at Gazprom.

From 2004 to 2007, held the position of Deputy Minister of Economic Development and Trade of the Russian Federation.

From 2007 to 2009, First Vice-President of Sistema Financial Corporation.

Since 10 April 2009, CEO of PJSC Aeroflot.

At different periods, Mr Saveliev served as chairman of the boards of directors at All-Russian Exhibition Centre (VVC), the Russian Bank for Development, MTS, Comstar, SMM, SkyLink, Indian Shyam Telelink, and other companies.

Recipient of the Order “For Merit to the Fatherland”, 4th class, the Order of Honour, the Order of Friendship; he was awarded a Letter of Acknowledgement from the President of the Russian Federation, numerous medals of the Russian Federation, and industry awards.

HAS A 0.121% SHAREHOLDING IN PJSC AEROFLOT.

VLADIMIR ANTONOV

First Deputy CEO for Aviation Safety

Born in 1953. Graduated from Moscow Railway Engineering Institute.

From 1977 to 1995, served in the armed forces.

From 1995 to 2011, Deputy CEO for Economic and Aviation Safety, Deputy CEO for Aviation Safety, Deputy CEO for Aviation and Operating Safety, and First Deputy CEO for Operations at PJSC Aeroflot.

Since 2011, First Deputy CEO for Aviation Safety at PJSC Aeroflot.

Recipient of a Medal of the Order “For Merit to the Fatherland”, 2nd class, other government and industry awards.

HAS A 0.000425% SHAREHOLDING IN PJSC AEROFLOT.

VASILY AVILOV

Deputy CEO for Administrative Management

Born in 1954. Graduated from Dzerzhinsky Higher Naval Engineering College.

From 1997 to 2013, Head of Administration, Director of the Administrative Department, Deputy CEO – Executive Director at PJSC Aeroflot.

Since 2013, Deputy CEO for Administrative Management at PJSC Aeroflot.

Recipient of a Medal of the Order “For Merit to the Fatherland”, 1st class, a Medal “For Battle Merit”, a Certificate of Honour of the President of the Russian Federation, and industry awards.

HAS A 0.0000002% SHAREHOLDING IN PJSC AEROFLOT.

VLADIMIR ALEXANDROV

Deputy CEO for Legal and Property Matters

Born in 1984. In 2005, graduated from Kutafin Moscow State Law University; in 2016, graduated from the Russian Presidential Academy of National Economy and Public Administration (RANEPA).

Held senior positions at the Prosecutor General’s Office of the Russian Federation and the Investigative Committee of the Russian Federation.

From 2013 to 2015, Deputy Head of the Legal Support Section of the Legal Department, Deputy Director of Legal Department, Advisor to the CEO for government relations.

In August 2015, he was appointed Legal Department Director at PJSC Aeroflot.

Since 1 July 2016, Deputy CEO for Legal and Property Matters at PJSC Aeroflot.

Has a Letter of Acknowledgement from the Minister of Transport of the Russian Federation.

NO SHAREHOLDING IN PJSC AEROFLOT.

KIRILL BOGDANOV

Deputy CEO for Information Technologies

Born in 1963. Graduated from Kalinin Leningrad Polytechnic Institute (St Petersburg Polytechnic University).

From 2002 to 2004, Advisor to the Vice-President at United Company GROS.

From 2004 to 2007, Executive Director of RAMAX International.

From 2007 to 2009, Director of Development and Control at Telecom Assets at Sistema Financial Corporation.

Since 2009, Deputy Head of the Information Systems Department at PJSC Aeroflot, Advisor to the CEO, Deputy CEO for Information Technologies.

Has a Letter of Acknowledgement from the President of the Russian Federation.

NO SHAREHOLDING IN PJSC AEROFLOT.

VADIM ZINGMAN

Deputy CEO for Customer Relations

Born in 1970. Graduated from the St Petersburg University of Economics and Finance. PhD in Economics.

From 2001 to 2008, Deputy Director of the Department for Government Regulation of Foreign Trade at the Ministry of Economic Development and Trade of the Russian Federation.

From 2008 to 2009, Director of Government Relations at Sistema Financial Corporation.

From 2009 to 2012, Advisor to the CEO, Deputy CEO for Customer Relations and Deputy CEO for Operations and Quality Management at PJSC Aeroflot.

Since 2012, Deputy CEO for Customer Relations at PJSC Aeroflot.

Recipient of a Medal of the Order “For Merit to the Fatherland”, 2nd class. Has a Letter of Acknowledgement from the President of the Russian Federation, a Letter of Acknowledgement from the Chairman of the Federation Council of the Federal Assembly of the Russian Federation, a Certificate of Honour of the Government of the Russian Federation, and various industry awards.

NO SHAREHOLDING IN PJSC AEROFLOT.

GIORGIO CALLEGARI

Deputy CEO for Strategy and Alliances

Born in 1959. Graduated from Turin Polytechnic University (Italy).

From 1986 to 1989, VP of Sales, member of the Board of Directors and the Executive Committee at Malan Viaggi.

From 1990 to 2011, sales manager, Vice-President for Sales, Vice-President for Business Development, Vice-President for Alliances, Business Development and International Relations, Executive Vice-President for Alliances and Strategies at Alitalia.

Since 2011, Deputy CEO for Strategy and Alliances at PJSC Aeroflot.

NO SHAREHOLDING IN PJSC AEROFLOT.

SHAMIL KURMASHOV

Deputy CEO for Commerce and Finance

Born in 1978. Graduated from the Moscow State Institute of International Relations (MGIMO University). PhD in Economics.

From 2004 to 2007, Deputy CEO for Finance and Investment at Sistema Telecom.

From 2007 to 2009, Director of Investments, Deputy Head of the Finance and Investment Division at Sistema Financial Corporation.

From 2009 to 2013, Advisor to the CEO, Deputy CEO for Finance and Investment, and Deputy CEO for Commerce and Finance at PJSC Aeroflot.

From 2013 to 2016, Deputy CEO for Finance and Network and Revenue Management at PJSC Aeroflot.

Since 2016, Deputy CEO for Commerce and Finance at PJSC Aeroflot.

Has a Letter of Acknowledgement from the President of the Russian Federation, a medal “For Impeccable Service and Distinction”, 3rd class, prestigious Russian and international awards.

NO SHAREHOLDING IN PJSC AEROFLOT.

GEORGY MATVEEV

Director of Safety Management

Born in 1953. Graduated from the Academy of Civil Aviation. PhD in Technical Science.

From 2001 to 2012, Deputy Chief Flight Safety Inspector and Deputy Director of Flight Safety Management at PJSC Aeroflot.

Since 2012, Director of Safety Management at PJSC Aeroflot.

Recipient of the honorary title of the Honoured Pilot of the Russian Federation, and numerous industry awards.

NO SHAREHOLDING IN PJSC AEROFLOT.

IGOR PARAKHIN

Deputy CEO – Technical Director

Born in 1961. Graduated from the Moscow Institute of Civil Aviation Engineers.

From 2001 to 2011, Head of Programme, Deputy Director of the Aviabusiness Higher Commercial School.

Since 2011, Acting Technical Director, Technical Director, Deputy CEO – Technical Director at PJSC Aeroflot.

Has a Letter of Acknowledgement from the President of the Russian Federation.

HAS A 0.000007% SHAREHOLDING IN PJSC AEROFLOT.

IGOR CHALIK

Deputy CEO – Flight Director

Born in 1957. Graduated from the Aktyubinsk Higher School of Civil Aviation.

From 2003 to 2008, Commander of the A320 Air Squadron at PJSC Aeroflot.

From 2008 to 2010, Commander of the A330 Air Squadron at PJSC Aeroflot.

Since 2011, Deputy CEO – Flight Director at PJSC Aeroflot.

Recipient of the honorary title of the Honoured Pilot of the Russian Federation, the Medal of Nesterov, and industry awards.

HAS A 0.000117% SHAREHOLDING IN PJSC AEROFLOT.

There were no changes in the membership of PJSC Aeroflot’s Management Board in 2017.

Management Board Report for 2017

In 2017, the Management Board of PJSC Aeroflot held a total of 39 meetings, including 8 meetings in absentia.

Key matters discussed in 2017:

- PJSC Aeroflot’s flight safety

- Technical condition of PJSC Aeroflot’s aircraft fleet

- Aeroflot Group’s development in the context of infrastructure constraints

- Implementation of PJSC Aeroflot’s Innovative Development Programme

- Implementation of the R&D plan

- Enhancement of Aeroflot Group’s IT

- Results of implementing the Big Data enabled dynamic segmentation project

- Preparation for the 2018 FIFA World Cup

- Promotion of PJSC Aeroflot’s strategic partnerships

- Opening of representative offices

- Shareholder and investor relations

- Implementation of updated elements of PJSC Aeroflot’s corporate philosophy

- Mentoring concept at PJSC Aeroflot

- Introduction of professional standards in PJSC Aeroflot’s operations

- Charity projects for a number of institutions

- Sponsorship initiatives

Committees

In pursuit of recommendations and proposals aiming to boost the Company’s performance, PJSC Aeroflot set up the Committee for Innovative Development and the Committee for Finance and Investments

Committee for Innovative Development

The Committee for Innovative Development is a permanent collective advisory body of PJSC Aeroflot’s Management Board. It was set up to develop recommendations and proposals for the Management Board to boost the Company’s performance.

In its operation, the Committee is guided by the laws of the Russian Federation, resolutions of PJSC Aeroflot’s Board of Directors and Management Board, other regulations, rules, and procedures of the Company, and the Regulations on the Committee for Innovative Development.

The Committee is charged with reviewing innovative projects and providing assessment of their efficiency, monitoring progress on the ongoing innovative projects, passing resolutions on project suspension, setting out requirements for the design and quality of innovative development materials submitted to the Management Board, and recommending projects for implementation.

In 2017, the Committee for Innovative Development held a total of three meetings and discussed the following matters:

- Establishing an innovation team responsible for expert review, analysis, and development of recommendations on key innovation decisions by engaging universities, research organisations, state innovation institutions, and the venture community

- Reviewing PJSC Aeroflot’s employee and manager incentive system to improve innovative performance when identifying solutions and prevent conflicts of interest when accepting third-party deliverables

- A concept of a crowdsourcing contest to introduce Block Chain and Big Data into Aeroflot’s operations

- The Innovative Development Programme progress in 2016

- A concept of developing an ongoing in-house innovation system

- Summarising the automated one-stop-shop system testing results

- Summarising expert reviews of proposals submitted via the one-stop-shop system

Membership of the Committee for Innovative Development as at 31 December 2017

| Vadim Zingman | Deputy CEO for Customer Service, Chairman of the Committee |

| Andrey Polozov-Yablonsky | Advisor to the CEO, Director for Innovation, Deputy Chairman of the Committee |

| Sergey Krylov | Director of the Information Systems Department |

| Aleksey Korenevsky | Deputy Director for Flight Training and Training Methodology of the Flight Operations Department |

| Azat Zaripov | Deputy Director of the Aviation Security Management Department |

| Dmitry Saksonov | Head of Strategic Projects Coordination at the Corporate Strategy Department |

| Ekaterina Kryshkina | Advisor to the Deputy CEO for Commerce and Finance |

| Alexander Fadeev | Advisor to the Deputy CEO and Technical Director |

Committee for Finance and Investments

The Committee for Finance and Investments is a permanent collective advisory body of PJSC Aeroflot. In its operation, the Committee is guided by the applicable laws of the Russian Federation, resolutions of PJSC Aeroflot’s Board of Directors, other regulations, rules, and procedures of the Company, and the Regulations on the Committee for Finance and Investments.

The Committee is charged, among other things, with monitoring progress on the Company’s ongoing investment projects, providing expert reviews of any such projects, passing resolutions on suspension of investment projects, determining their performance assessment criteria, and drafting proposals on Aeroflot Group’s financial, economic, and marketing policies.

In 2017, the Committee for Finance and Investments held a total of 23 meetings including 21 meetings in absentia.

Membership of the Committee for Finance and Investments as at 31 December 2017

| Shamil Kurmashov | Deputy CEO for Commerce and Finance, Chairman of the Committee |

| Giorgio Callegari | Deputy CEO for Strategy and Alliances |

| Irina Nikolaeva | Chief Accountant |

| Evgeny Zenchenko | Director of the Corporate Strategy Department |

| Anton Lopatin | Director of the Financial Planning and Analysis Department |

| Arkady Petrosyan | Director of the Risk Management Department |

| Mikhail Safarov | Director of the Product Management Department |

| Andrey Sogrin | Director of the Public Relations Department |

| Ilya Tonkonozhenko | Director of the Administrative Department, Secretary of the Committee |

| Andrey Chikhanchin | Director of the Corporate Finance Department |

| Vasily Timofeev | Acting Director of the Financial Operations Department |

| Sergey Sumarokov | First Deputy Director of the Department for Economic Security |

| Elena Shilina | Deputy Director of the Corporate Finance Department |

| Dmitry Galkin | Advisor to the Deputy CEO for Administrative Management |

| Andrey Polozov-Yablonsky | Advisor to the CEO, Director for Innovation |

Remuneration of members of the Board of Directors and the management

The Company has in place a structured remuneration system for members of the governing bodies designed to link the amount of bonus payments to the achievement of short-term targets, and align the long-term interests of the Company’s management and its shareholders. Short-term incentive is provided in the form of cash bonuses, while long-term incentive implies payments based on share capitalisation benchmarked against different metrics.

Remuneration of members of the Board of Directors

Guidelines for Board remuneration calculation and payouts are set forth in the Regulations on Remuneration and Compensation Payments to the Members of the Board of Directors of PJSC Aeroflot, in line with the Federal Law On Joint-Stock Companies, other applicable laws of the Russian Federation, and the Company’s internal documents. These Regulations were approved by PJSC Aeroflot’s AGM on 26 June 2017.

The Board remuneration framework comprises a fixed component and the Long-Term Incentive Programme (a variable component). The size of the fixed component depends on involvement of members of PJSC Aeroflot’s Board of Directors in its activities and includes the fixed base pay and additional payments for discharging extra duties. The variable remuneration component is directly linked to the Company’s market capitalisation, achievement of the capitalisation target, and the market capitalisation of key foreign airline peers. The Long-Term Incentive Programme is focused on achievement of the Company’s capitalisation target.

The Long-Term Incentive Programme for 1 January 2016 to 30 June 2019 was approved in 2016 to replace the previous Stock Option Plan for 2013–2015. During the implementation, the current Long-Term Incentive Programme is adjusted to update its metrics.

The total variable remuneration of Board members is equivalent to 0.5% of PJSC Aeroflot’s market capitalisation growth over the lifetime of the Long-Term Incentive Programme. The 2016–2019 Long-Term Incentive Programme draws heavily on the following underlying metrics:

- Metric 1 (maximum weight of ½): the Company’s market capitalisation growth in the relevant year

- Metric 2 (maximum weight of ½): PJSC Aeroflot’s ranking among five foreign airline peers based on the market capitalisation change in the relevant year

⅓ of the remuneration pool accrued for the relevant interim period is paid out to Board members simultaneously with the fixed remuneration for the relevant year.

⅔ of the remuneration pool accrued for the relevant interim period is not paid out but set aside until the end of the Long‑Term Incentive Programme (June 2019), added together and paid out as a lump sum upon resolution of the General Meeting of the Company’s Shareholders, subject to the achievement of the capitalisation target. Calculations incorporate the high water mark principle, i.e. if capitalisation goes below the high water mark in the current interim period, the capitalisation growth base for the next interim period shall be the peak capitalisation value reached in the past period.

Management remuneration

The remuneration system designed for the management and the other staff enables the Company to engage and retain highly qualified professionals. Remuneration of management is comprised of the fixed component (official salary) and the variable component (current bonuses and long-term incentives).

Current bonuses depend on the Group-wide performance and are calculated in accordance with the Company’s KPI-Based Employee Bonus System. The KPI-Based Employee Bonus System is formalised by the Regulations on Bonus Payments to the Managers and Specialists of PJSC Aeroflot. The Regulations stipulate that the variable component of the management compensation amount shall depend on their quarterly and annual performance against the KPIs approved for the relevant reporting period.

To provide for long-term incentives for PJSC Aeroflot’s management, the Long-Term Incentive Programme for 1 January 2016 to 30 June 2019 was approved by the Board of Directors on 26 May 2016 and updated by the resolution of the Board of Directors of PJSC Aeroflot on 25 May 2017. The Programme covers the CEO, members of the Management Board, department heads, Chief Accountant, and other employees of the Company, on the CEO’s resolution. As at the end of 2017, 54 employees were enrolled in the Programme. The total pool of the Long-Term Management Incentive Programme is equivalent to 3.0% of PJSC Aeroflot’s market capitalisation growth over the lifetime of the Long-Term Incentive Programme. The 2016–2019 Long-Term Management Incentive Programme draws heavily on the following underlying metrics:

- PJSC Aeroflot’s market capitalisation growth in each relevant interim period

- PJSC Aeroflot’s ranking among five international airline peers based on the market capitalisation change in each relevant interim period

- Achievement of the capitalisation target following the Long- Term Incentive Programme

The annual remuneration is paid as follows:

- ⅔ of the remuneration pool is paid out for the relevant interim period

- ⅓ of the remuneration pool is set aside until the end of the Long-Term Incentive Programme (June 2019) and paid out subject to the achievement of the capitalisation target

KPI system

The list and weights of KPIs for the CEO of PJSC Aeroflot for 2017, which form part of the corporate KPI system, were approved by the Board of Directors of PJSC Aeroflot on 24 November 2016 (Minutes No. 6). The 2017 KPI targets for the CEO of PJSC Aeroflot were approved by the Board of Directors of PJSC Aeroflot on 22 December 2016 (Minutes No. 7).

From 2015 onward, the scope of the CEO’s KPI list (with KPI weights and targets) is fully in line with the KPIs of our Long-Term Development Programme and extended to include all members of PJSC Aeroflot’s Management Board to provide incentives for the management to pursue Group-wide corporate objectives and improve the Group’s overall performance. The KPIs for other employees of PJSC Aeroflot were approved by the CEO’s Order No. 465 dated 30 December 2016.

Pursuant to the directives of the Russian Government, PJSC Aeroflot’s KPI system embraces financial, economic and industry specific indicators, including:

- mandatory financial KPIs – Total Shareholder Return (TSR) and ROIC for Aeroflot Group – in line with the KPI Guidelines (Letter of the Federal Agency for State Property Management No. OD-11/22160 dated 26 May 2014)

- Overall Productivity KPI (for Aeroflot Group) – in line with the Russian Government’s Directive No. 6362p-P13 dated 24 October 2013

- Share of Supplies from Small and Medium-Sized Businesses, Efficient Energy Use, and Environmental Friendliness KPIs were incorporated into PJSC Aeroflot’s KPI system and KPI lists for relevant department heads – in line with the Russian Government’s Directive No. 6362p-P13 dated 24 October 2013

- Integrated Innovation Key Performance Indicator (IIKPI) (for Aeroflot Group) – in line with Letter of the Deputy Minister of Economic Development of the Russian Federation No. 3142-OF/D06 dated 24 February 2012 and the Russian Government’s Directive No. 1472p-P13 dated 3 March 2016

- Investment Programme Efficiency KPI (for Aeroflot Group) – in line with Directive of the Federal Agency for State Property Management No. PF-11/35029 dated 14 August 2014

- CASK KPI (for Aeroflot Group). As per the resolution of PJSC Aeroflot’s Board of Directors dated 20 April 2017 (Minutes No. 14), the Company achieved the CASK reduction target in line with Directives of the Russian Government No. 2303p-P13 dated 16 April 2015 and No. 4750p-P13 dated 4 July 2016. Since 2017, the Company’s objective is to maintain the achieved level

- Share of State-Subsidised Funding in Total Funding Secured KPI – in line with paragraph 2 of Instruction of the Russian Prime Minister No. AD-P36-4617 dated 11 July 2015 on including the indicator showing investment capital raised in the private equity market.

As per the resolution of PJSC Aeroflot’s Board of Directors dated 20 April 2017 (Minutes No. 14), Aviation Accident with fatalities (Plane Crash) was set as the disqualification indicator (cancelling the bonus) in the KPI system.

2017 KPI targets for the CEO of PJSC Aeroflot

| KPI | Unit | 2016 | 2017 | Reasons for inconsistencies (2017A vs 2017P) | ||||||

| Weight, % | Plan | Actual | Performance to plan, % | Weight, % | Plan | Actual | Performance to plan, % | |||

| Total Shareholder Return (TSR) | % | 10.0 | 89.7 | 176 | 196.2 | 10.0 | 13.5 | 1.2 | 8.89 | Decrease is due to changes in the share price resulting from:

|

| ROIC | % | 20.0 | 17.3 | 21.1 | 122.0 | 20.0 | 14.9 | 14.9 | 100.00 | |

| Long-Term Debt / EBITDAR | – | 5.0 | 1.3 | 1.0 | 123.1 | 5.0 | 0.93 | 0.86 | 107.53 | Financial leverage reduction was due to the depreciation of the US dollar in late 2017 (plan rate – RUB 67 per US dollar, actual rate – RUB 57.6 per US dollar), which drove a reduction in the rouble equivalent of finance lease liabilities. |

| Integrated Innovation Key Performance Indicator (IIKPI) | % | 10.0 | 80 | 96 | 119.7 | 10.0 | 80 | 80* | 100.00 | |

| Investment Programme Efficiency | – | 5.0 | 6.05 | 10.22 | 168.9 | 5.0 | 5.22 | 6.88 | 131.80 | High returns on the 2017 investment projects and lower capex. |

| CASK Reduction | % | 5.0 | 2.0 | 2.0 | 100.0 | N/A | As per the resolution of PJSC Aeroflot’s Board of Directors, the indicator was replaced with the CASK KPI (for Aeroflot Group) (for more details see above). | |||

| CASK | cent per ASK | N/A | 5.0 | 4.9 | 5.32 | 91.43 | The rouble appreciation against the US dollar in 2017 led to a higher US dollar equivalent of the rouble-denominated costs which account for almost half of Aeroflot Group’s total operating costs. | |||

| Share of State-Subsidised Funding in Total Funding Secured | % | 5.0 | 0.0 | 0.0 | 100.0 | 5.0 | 0.0 | 0.0 | 100.0 | |

| Punctuality | % | 5.0 | 86.0 | 89.2 | 103.7 | 5.0 | 87.0 | 90.4 | 103.91 | Aeroflot Group’s initiatives to improve punctuality of aircraft departures include:

|

| PJSC Aeroflot’s Flight Safety | % | 15.0 | 99.957 | 99.975 | 104.2 | 15.0 | 99.957 | 99.972 | 103.49 | Effective flight safety management, including:

|

| Passenger Load Factor | % | 10.0 | 81.1 | 81.5 | 100.5 | 10.0 | 80.0 | 82.8 | 103.50 | Higher utilisation of aircraft fleet capacity through:

|

| Overall Productivity | mn ASK per emp. | 10.0 | 3.951 | 4.010 | 101.5 | 10.0 | 4.235 | 4.431 | 104.62 | Higher productivity levels across Aeroflot Group were supported by actual delivering the actual work loads for 2017 and optimising headcount growth. |

In 2017, the majority of the Long-Term Development Programme KPIs for PJSC Aeroflot’s management were met/exceeded as a result of efficient operations. Failure to meet the KPI targets was due to the impact of macroeconomic factors.

The 2018 KPI list, weights, and targets for PJSC Aeroflot’s CEO were approved by PJSC Aeroflot’s Board of Directors on 21 December 2017 (Minutes No. 7). The updated 2018 KPI targets for the CEO of PJSC Aeroflot were approved by the Board of Directors of PJSC Aeroflot on 26 April 2018 (Minutes No. 13).

The list and weights of the 2018 KPIs for the CEO comply with the guidelines issued by federal executive authorities, and reflect the Company’s specifics and strategic priorities.

2018 KPI targets for PJSC Aeroflot’s CEO

| KPI | Unit | Weight, % | Plan |

| Total Shareholder Return (TSR) | % | 10.0 | 20.0 |

| Return on Invested Capital (ROIC) | % | 20.0 | 15.2 |

| Long-Term Debt / EBITDAR | – | 5.0 | 0.67 |

| Integrated Innovation Key Performance Indicator (IIKPI) | % | 10.0 | 100.0 |

| Investment Programme Efficiency | – | 5.0 | 4.42 |

| CASK | cent per ASK | 5.0 | 4.9* |

| Share of State-Subsidised Funding in Total Funding Secured | % | 5.0 | 0.0 |

| Punctuality | % | 5.0 | 87.0 |

| PJSC Aeroflot’s Flight Safety | % | 15.0 | 99.957 |

| Passenger Load Factor | % | 10.0 | 82.7 |

| Overall Productivity | mn ASK per emp. | 10.0 | 4.334 |

Remuneration of the Board of Directors and the Management Board in 2017

In 2017, in line with Long-Term Incentive Programmes, remuneration was paid based on the results of two reporting periods specified in the programmes: from 1 January to 30 June 2016 and from 1 July 2016 to 30 June 2017.

On 26 June 2017, the Annual General Meeting of Shareholders resolved to:

- pay to the members of PJSC Aeroflot’s Board of Directors the fixed component for the period from 1 January to 30 June 2016 in the amount of RUB 38,769,470

- approve the remuneration payable to the members of PJSC Aeroflot’s Board of Directors under the Long-Term Incentive Programme for the period from 1 January to 30 June 2016 in the amount of RUB 64.2 million, of which 50% (RUB 32,118,180) shall be paid out and the remaining 50% shall be reserved, with payment postponed until the end of the Long-Term Incentive Programme

- pay to the members of PJSC Aeroflot’s Board of Directors the fixed component for the period from 1 July 2016 to 30 June 2017 in the amount of RUB 69,300,000.

Remuneration of members of PJSC Aeroflot’s Board of Directors paid in 2017

| Member of the Board of Directors | Remuneration for the period from 1 January 2016 to 30 June 2016 | Remuneration for the period from 1 July 2016 to 30 June 2017 | |

| fixed component, RUB | remuneration under the Long-Term Incentive Programme, RUB | fixed component, RUB | |

| Kirill Androsov | 5,210,526 | 4,316,610 | 9,900,000 |

| Mikhail Alekseev | 3,107,368 | 2,574,270 | 6,750,000 |

| Alexey Germanovich | – | – | 8,550,000 |

| Igor Kamenskoy | 4,547,368 | 3,767,220 | 10,350,000 |

| Marlen Manasov | 4,232,368 | 3,506,260 | – |

| Roman Pakhomov | 6,752,368 | 5,593,930 | 10,350,000 |

| Dmitry Peskov | 4,232,368 | 3,506,260 | 6,750,000 |

| Vitaly Saveliev | – | – | – |

| Dmitry Saprykin | – | – | – |

| Vasily Sidorov | 6,632,368 | 5,494,520 | 10,350,000 |

| Yury Slyusar | 3,107,368 | 2,574,270 | 4,500,000 |

| Sergey Chemezov | 947,368 | 784,840 | 1,800,000 |

| Total | 38,769,470 | 32,118,180 | 69,300,000 |

The remuneration (salary, additional compensations, and bonuses) paid to the members of PJSC Aeroflot’s Management Board in 2017 totalled RUB 694,758,610 (in 2016, the remuneration totalled RUB 598,825,846). Remuneration under the Long-Term Incentive Programme was also paid in the reporting period and totalled RUB 2,238,417,192; in 2016, no such payments were made.

Remuneration of members of PJSC Aeroflot’s Management Board paid in 2017

| Remuneration type | Amount, RUB |

| Salary and additional compensations | 410,171,226 |

| Bonuses | 281,439,324 |

| Other income | 3,148,060 |

| Total | 694,758,610 |

Directors and officers liability insurance

As part of its efforts to provide insurance protection, PJSC Aeroflot has signed an agreement for liability insurance of the Company’s directors and officers, as well as representatives of PJSC Aeroflot on governing bodies of its subsidiaries, providing for reimbursement for loss caused to third parties, arising from claims filed by third parties against the insured due to their wrongful acts committed in their management roles. A securities claim filed against the Company also constitutes an insured event.

The amount of insurance coverage is USD 100 million per claim and in total. The insurance period is one year. The total insurance premium is USD 99 thousand.

Regulation of possible conflicts of interest within PJSC Aeroflot’s governing bodies

Conflicts of interest at PJSC Aeroflot are regulated by the following documents:

- Corporate Conduct Code of PJSC Aeroflot

- Procedure for reporting to the employer on personal interest that leads or may lead to a conflict of interest

- Aeroflot Group’s Anti-Corruption Policy

Internal control and audit

Aeroflot Group has in place a centralised internal audit function, headed by the Director of the Internal Audit Department who functionally reports to the Board of Directors of PJSC Aeroflot and to the Audit Committee of the Board of Directors.

Depending on the scale of their business and related risks, the Company’s controlled entities arrange for internal audit to be conducted by either PJSC Aeroflot’s Internal Audit Department or the internal audit unit or permanent internal auditor of their own. Heads of such units and internal auditors of controlled entities functionally report to the Director of the Internal Audit Department of PJSC Aeroflot.

The internal control systems are designed to maximise the Aeroflot Group’s transparency, financial performance, and compliance with the applicable laws.

Audit Committee and its role

The Board of Directors of PJSC Aeroflot approves internal documents regulating its general policy on risk management and internal controls and establishes principles of, and approaches to, the risk management and internal control system within PJSC Aeroflot.

The Audit Committee of PJSC Aeroflot’s Board of Directors enhances supervision over financial and business operations to optimise capex, protect shareholder interests, and ensure the growth of PJSC Aeroflot’s assets.