Sales and Distribution

Aeroflot sells tickets both for own flights and flights of subsidiary Rossiya and Aurora airlines operated under Aeroflot’s single airline code1. Subsidiary airlines sell tickets for own flights independently. Pobeda airline offers air tickets through own website and online booking systems.

Commercial management of flight loads for services operated by subsidiary airlines under codeshare agreements enables Aeroflot to centralise management for sales, revenue, route network, and fleet planning across the Group.

Aeroflot sells tickets in Russia and abroad through a variety of channels, including Aeroflot’s agents operating under direct agency agreements, agents-participants of various projects (BSP, ARC, Transport Clearing House (TCH)), own sales offices, and Aeroflot’s website and call centre.

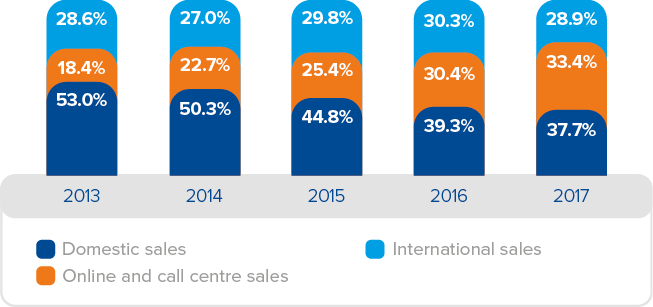

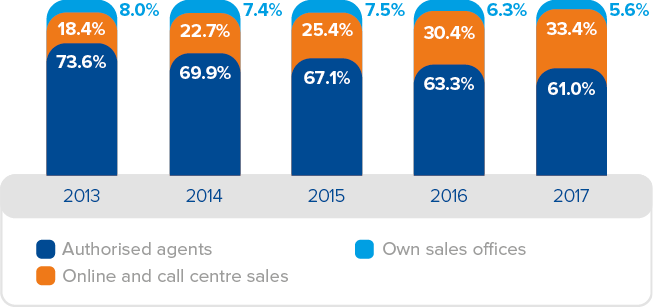

Online sales are actively growing, driven by more accessible and easy-to-use web apps, and the growing number of mobile digital devices. The share of PJSC Aeroflot online sales (including the call centre) grew from 18.3% to 33.4% over the past five years. Channel-wise, agents remain the biggest contributor to sales (61.0%) while own sales offices accounted for 5.6% of total sales.

Several new domestic and international services (from Moscow to Lisbon, Kostanay, Belgorod, Salekhard, and Khanty-Mansiysk) were launched in 2017, with significant capacity additions on some other routes (e.g. to Delhi, New York, London, and Antalya). To attract passengers to new routes and additional flights, a number of joint marketing activities were run with agents, meetings were held with major agents in the relevant markets, and newsletters were sent out across the agent network.

Special levers such as an additional distribution fee for agents in Russia, incentive fee agreements for international agents, and consolidator fares were used to incentivise agents to boost sales for new routes and additional flights.

Sales in Russia

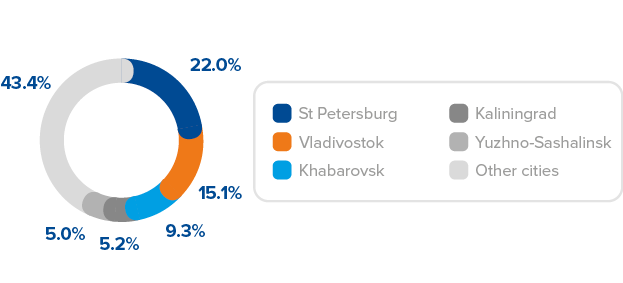

In Russia, Moscow (65.7%), Saint Petersburg, and the Russian Far East accounted for the largest share in Aeroflot’s total sales in 2017.

The share of sales through agents in Russia reduced overall due to a partial migration of sales online. The share of agents with BSP and TCH projects in Russia declined to 70.1% year-on-year while sales via authorised agents increased to 18.5%. Sales through own sales offices were flat year-on-year at 11.4%.

International sales

- ramping up ticket sales on international transit routes between Europe and Asia (especially on routes from China, India, and Kazakhstan), as well as between the USA and Israel

- signing incentive fee agreements with major agents in the relevant markets to drive sales of tickets for Aeroflot’s flights

- developing corporate sales (targeting primarily major foreign companies with operations in Russia or using Moscow as a transit point for business trips between Europe and Asia or Europe and the CIS)

- improving cost-per-sale performance.

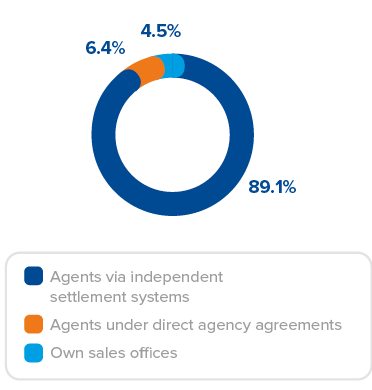

Sales via agents with BSP, ARC, and TCH projects accounted for 89.1% of total sales in 2017. Sales through authorised agents totalled 6.4%, and sales via own offices contributed 4.5% to total sales.

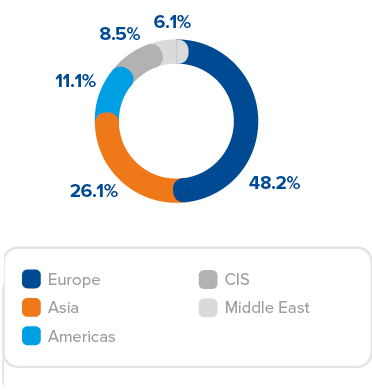

Split by region, Europe was the biggest contributor to total international sales in 2017 (48.2%), followed by Asia (26.1%), the Americas (11.1%), the CIS (8.5%), and the Middle East (6.1%).

Corporate sales

Aeroflot Group is actively developing its corporate sales. Revenue from sales to corporate customers continued to grow in 2017. Aeroflot’s corporate customers include a variety of oil and gas, finance, pharmaceutical, retail, food, and construction companies.

Our corporate sales target global companies with representative offices or business projects in Russia or the CIS, major international and regional Russian companies, and state-funded institutions.

NDC project

In 2017, Aeroflot was granted the highest, Level 3 certification for its implementation of the New Distribution Capability (NDC) Standard developed by the IATA.

The NDC programme enables the industry to transform the way air products are distributed. Going forward, NDC functionality will enable air product customisation to each customer’s specific budget and preferences, and help promote the entire range of value added services and fare families offered by an airline. NDC will allow customers to purchase air products and services via metasearch engines and agents accessing Aeroflot’s NDC gateway.

As at the end of 2017, NDC was implemented for metasearch engines only.

Pricing policy

In 2017, Aeroflot continued to develop and enhance the new fare structure comprising four fare families (fare brands) to which the Company shifted in November 2016. This was achieved through optimising the price differences between the different fare families to enhance passengers’ ability to choose fares that best match their needs, and by expanding the range of value-added services available for each fare family.

As a premium airline focused on a network business model, Aeroflot made a point of keeping free baggage allowance for checked and carry-on baggage across all fare families despite the regulatory changes allowing carriers to introduce baggage-free fares.

Aeroflot employs a set of analytical tools and automated software systems to maximise revenue. Each individual system plays its part in improving existing business processes and enhancing seat inventory management on Aeroflot’s flights. The use of advanced IT systems drives efficiencies and better flight loads while meeting the needs of different customer segments with varied spending capacity.

Fares for international flights remained mostly flat throughout 2017. One of the key targets in 2017 was maintaining the overall share of transit traffic and increasing it on certain routes without eroding the average yield. Pressure from predatory pricing by competitors on transit routes was offset by additional promotional fares and changes to the Company’s supply strategies.

Improved affordability of air travel for retail customers, specifically lower available fares in the domestic market, and lower rouble prices for international flights due to rouble appreciation pushed the demand for air travel. Despite the rise in demand, Aeroflot continued to stick to a conservative pricing policy.

1 Aeroflot’s sales include revenue of Aeroflot airline and revenue from flights by Rossiya and Aurora subsidiary airlines under 100% commercial management.