Investor Relations, Equity and Debt

Share capital

As at 31 December 2017, PJSC Aeroflot’s charter capital consisted of 1,110,616,299 ordinary registered uncertificated shares with a par value of RUB 1 each. The Company did not issue preferred shares.

State registration numbers of PJSC Aeroflot’s ordinary share issues are 73-1 p-5142 (dated 22 June 1995) and 1-02-00010-A (dated 1 February 1999). These issues were merged by Decree No. 04-168/r of the Federal Securities Commission of Russia dated 23 January 2004, following which the issues of PJSC Aeroflot ordinary shares were assigned state registration number 1-01-00010-A on 23 January 2004.

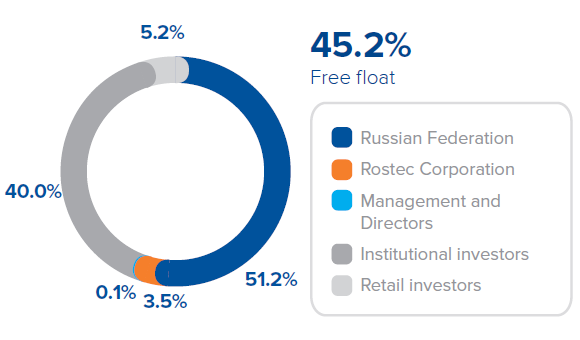

Key shareholders of PJSC Aeroflot

| Holder | Status* | As at 31 December 2016 | As at 31 December 2017 | Change of shareholding, p.p. | ||

| Number of shares | Shareholding, % | Number of shares | Shareholding, % | |||

| Legal entities | 1,048,923,212 | 94.45 | 1,053,301,607 | 94.84 | 0.39 | |

| including: | ||||||

| Russian Federation (represented by the Federal Agency for State Property Management) | O | 568,335,339 | 51.17 | 568,335,339 | 51.17 | – |

| National Settlement Depository | N | 387,462,361 | 34.89 | 445,556,945 | 40.12 | 5.23 |

| Aeroflot-Finance** | O | 53,716,189 | 4.84 | – | – | (4.84) |

| RT-Business Development | O | 16,720,724 | 1.51 | 16,720,724 | 1.51 | – |

| Aviacapital-Service*** | O | 22,688,599 | 2.04 | 22,688,599 | 2.04 | – |

| Individuals**** | O | 61,693,087 | 5.55 | 57,314,692 | 5.16 | (0.39) |

* O means “owner”, N means “nominee”.

** Aeroflot-Finance’s stake includes the stake held by nominees, with the number of quasi-treasury shares unchanged in 2014–2016.

*** Aviacapital-Service’s stake includes the stake held by nominees.

**** Partially including the management and members of the Board of Directors.

In addition to outstanding shares, the Company has the right to issue a further 250 million ordinary registered shares (authorised shares). No additional shares were issued in 2017.

The total number of PJSC Aeroflot’s shareholders as at 31 December 2017 was 11,101, vs 11,377 as at 31 December 2016, comprising mostly individuals.

PJSC Aeroflot’s register of shareholders is kept by Independent Registrar Company (License No. 045-13954-000001, issued by the Bank of Russia). The register holder’s details are provided in the Contact Details appendix to this Annual Report.

Shares

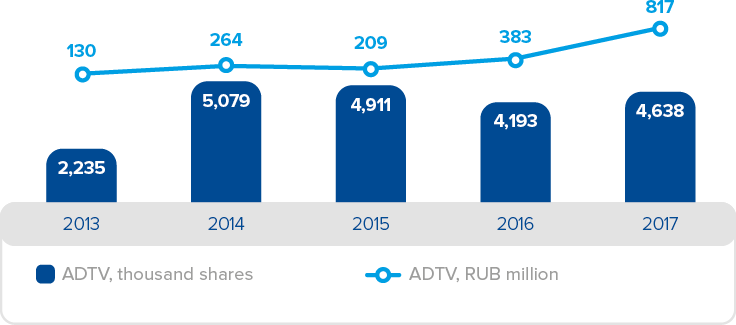

PJSC Aeroflot shares and depositary receipts are traded on the stock market. Ordinary shares are traded on the Russian market, and global depositary receipts (GDRs) are traded on foreign markets.

PJSC Aeroflot shares are traded on the Moscow Exchange, where as at 31 December 2017 they were included in the Level 1 Quotation List (AFLT: MOEX). Securities transactions are subject to the T+2 trading mode. PJSC Aeroflot shares are included in the main Russian stock indices: MOEX Russia Index, MICEX Broad Market Index (RUB and USD), MICEX Transport Index (RUB and USD), MICEX 10 Index, and RTS Index.

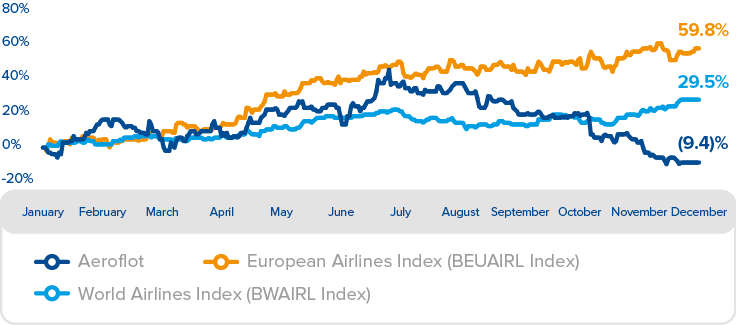

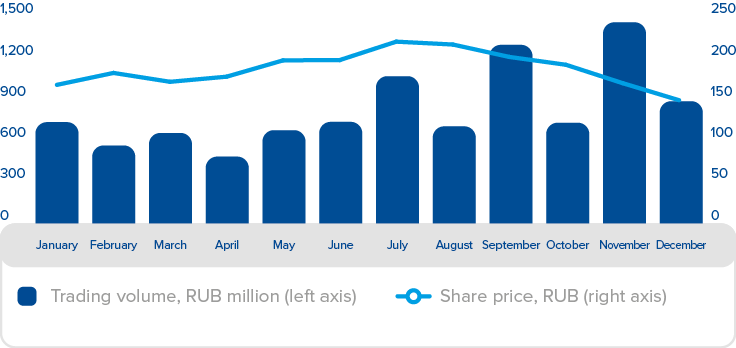

As at 31 December 2017, PJSC Aeroflot’s market capitalisation was RUB 153.8 billion, down 9.4% year-on-year.

PJSC Aeroflot share price was strongly driven by the general trend in the Russian stock market: as at the year-end, PJSC Aeroflot share price changed relatively on par with MOEX Russia Index (down by 9.4% and 5.5%, respectively). The external factors that affected the Group’s financial performance, including growing fuel prices due to higher oil prices in the global market and the rouble appreciation against global currencies in the reporting period (vs 2016), were an additional source of pressure on the share price.

Note. The average daily trading volume was calculated based on the closing price.

Airline stock indices grew in 2017, supported by the stronger financial performance of some companies and the overall better environment in some regional markets, which indicates that this growth was driven by the low base of the previous years. In addition, segment share prices were supported by the positive investor outlook on the air transportation industry in the medium-term.

Analyst recommendations

| Date | Recommendations | Bloomberg consensus forecast, RUB |

Target price range, RUB |

Number of analysts |

|||

| 31.12.2017 | 31% | 46% | 23% | 186.0 | 132.0 – 233.0 | 13 | |

| 31.12.2016 | 75% | 17% | 8% | 158.0 | 121.0 – 184.0 | 12 | |

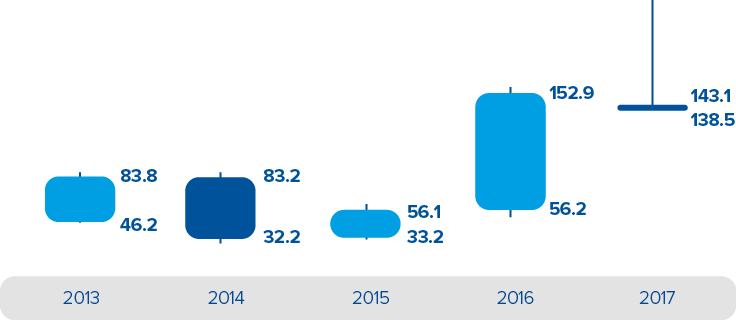

Price per PJSC Aeroflot share

RUB

| 2013 | 2014 | 2015 | 2016 | 2017 | |

| First trading day | 46.2 | 83.2 | 33.2 | 56.2 | 143.1 |

| High | 85.1 | 88.0 | 61.0 | 158.4 | 225.0 |

| Low | 46.2 | 29.9 | 32.5 | 50.4 | 137.0 |

| Last trading day | 83.8 | 32.2 | 56.1 | 152.9 | 138.5 |

GDR and ADR programmes

Outside Russia, PJSC Aeroflot shares are traded as global depositary receipts (GDRs) at the over-the-counter section of the Frankfurt Stock Exchange. One GDR represents five ordinary shares. Deutsche Bank Trust Company Americas acts as the depositary bank, and LLC Deutsche Bank is the custodian. A total of 8,527,895 shares were converted into GDRs as at 31 December 2017, representing 0.8% of the charter capital. No shares were converted into ADRs. As at 31 December 2017, the price of one depositary receipt stood at EUR 9.91, down 14.6% year-on-year.

PJSC Aeroflot’s GDR programme

| Programme type | Sponsored Level-1 GDRs under Regulation S and Rule 144A |

| Ratio (shares: GDR) | 5:1 |

| Ticker | AETG |

| ISIN | US69343R1014 |

PJSC Aeroflot’s Level-1 ADR programme

| Programme type | Sponsored Level-1 ADRs |

| Ratio (shares: ADR) | 5:1 |

| Ticker | AERZY |

| ISIN | US69343R3093 |

Credit ratings

PJSC Aeroflot has a credit rating from Fitch Ratings. In November 2017, the rating agency affirmed the Company’s Long-Term Local and Foreign Currency Issuer Default Rating (IDR) at B+ and put it under review for a possible upgrade to a Positive outlook.

Fitch Ratings upgraded Aeroflot’s credit rating to BB– with a Stable outlook in March 2018.

The upgraded credit rating reflects the positive trend in the Russian transportation industry, improved financial and business performance of the Company, and updated rating guidance for partially state-owned companies. When rating the Company, Fitch Ratings considered its strengths including the extensive and diversified route network, successful hub enhancement strategy, competitive costs, and strong position of the carrier in Russia.

Dividend policy

Dividend policy is a key corporate governance element and a key measure of a company’s performance in upholding the rights of its investors.

PJSC Aeroflot has in place the Regulations on the Dividend Policy, which seek to maximise the transparency of procedures used to determine the amount of dividends and pay them out to the benefit of shareholders and investors. The Regulations determine the approach used by the Board of Directors to make recommendations for the General Meeting of Shareholders on profit distribution, including dividend payout.

The key principles of PJSC Aeroflot’s dividend policy are as follows:

- Aeroflot Group’s consolidated net income under the International Financial Reporting Standards (IFRS) forms the base for calculating dividends

- The amount of dividend is calculated using a tailored system of ratio indicators, which factors in the results of the reporting year, Aeroflot Group’s debt ratio, and mid-term financial plan

- The target level of dividend payouts is set at 25% of Aeroflot Group’s IFRS net income

The Annual General Meeting of Shareholders held on 26 June 2017 approved a dividend payout for FY2016 at 50% of Aeroflot Group’s net income reported in its consolidated IFRS statements. The dividend was RUB 17.48 per ordinary share, a record high in the modern history of the Company.

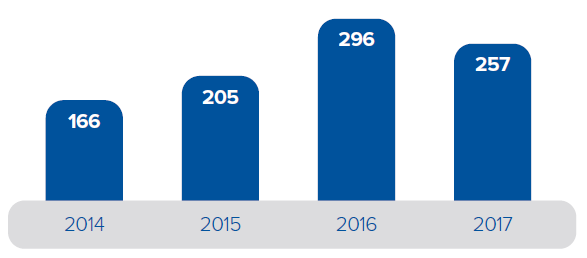

Investor relations

The Company is strongly focused on its relations with existing and prospective investors. PJSC Aeroflot communicates with investors by providing objective, reliable, and consistent information about its activities and complies with current disclosure standards, seeking to maximise transparency.

The Company maintains a continued dialogue with shareholders and investors to ensure that securities market participants get complete information about its activities. The Company timely discloses material information on its operations as press releases and material facts via authorised disclosure platforms, in full compliance with Russian laws. The Company makes regular disclosures in its IFRS and RAS financial statements and releases investor presentations on its official website.

Aeroflot’s Capital Markets Day held in December 2017 featured PJSC Aeroflot’s management and subsidiary airlines’ leaders. The event was attended by over 50 investors, with 30 more investors linked up via a video webcast.

Capital Markets Day’s participants had a positive stance on the presented long-term strategic goals, 2018 business forecasts, and additional disclosures by subsidiary airlines, including Pobeda airline’s financial performance.

To enhance investor transparency and experience, a Databook was launched in the IR section of the website in July 2017. The Databook discloses public information on Aeroflot Group’s business and the air transportation market and is aimed at facilitating the Group’s performance review by investors and analysts.

JSC AEROFLOT TARGETS INVESTORS VIA THE FOLLOWING CHANNELS:

| PJSC AEROFLOT TARGETS INVESTORS VIA THE FOLLOWING CHANNELS: | ||||

Conference calls with the Company’s management | Regular meetings with investors and shareholders | Involvement in major conferences hosted by brokerage houses | Site visits to the Company’s facilities | Dedicated events for investors and shareholders, with presentations by the Company’s management (Capital Markets Days) |

2017 IR highlights

Sale of quasi-treasury stock of PJSC Aeroflot

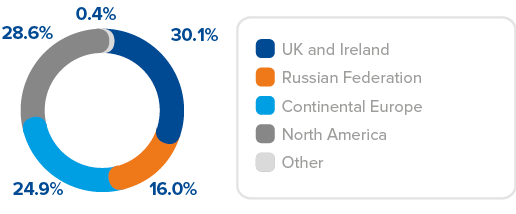

In September 2017, a quasi-treasury stock of PJSC Aeroflot totalling 4.84% of its charter capital was sold through accelerated bookbuilding. The buyers included a wide range of international investors from the UK and continental Europe, as well as Russian investment funds.

The bookbuild price was at RUB 182 per ordinary share, a 4.2% discount to the pre-launch closing price. Following the sale, PJSC Aeroflot’s free float increased to 45.2%.

IN 2017, THE COMPANY’S INVESTOR RELATIONS WERE RECOGNISED BY A NUMBER OF AWARDS

Investor Relations

Aeroflot’s IR team received the Grand Prix for Best Overall Investor Relations (Top 3) from IR Magazine Russia & CIS and for the fourth year in a row was named the best in the transport sector.

Aeroflot’s IR team received the IR Rising Star award from IR Magazine Europe . Head of Aeroflot’s IR is the only leader from Russia, Eastern Europe, and emerging markets nominated in the IR Rising Star category.

Annual Report

Aeroflot’s 2016 Annual Report was named the

winner in the

Best Annual Report of the Company

with the Market Capitalisation of RUB 40 Billion

to RUB 200 Billion category

of the Annual Report

Competition hosted by the Moscow Exchange.

Aeroflot’s 2016 Annual Report also won in a number

of categories at Vision Awards hosted by the League

of American Communications Professionals (LACP),

including:

- Platinum Medal in the Transportation & Logistics category

- Top 100 Reports Worldwide

- Top 20 Reports in the EMEA Region

- Top 20 Russian Reports.