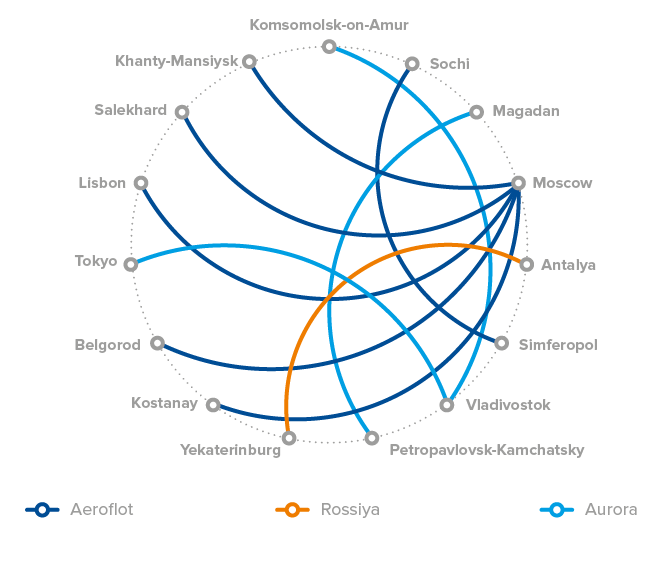

Route Network

Aeroflot Group’s route network development1

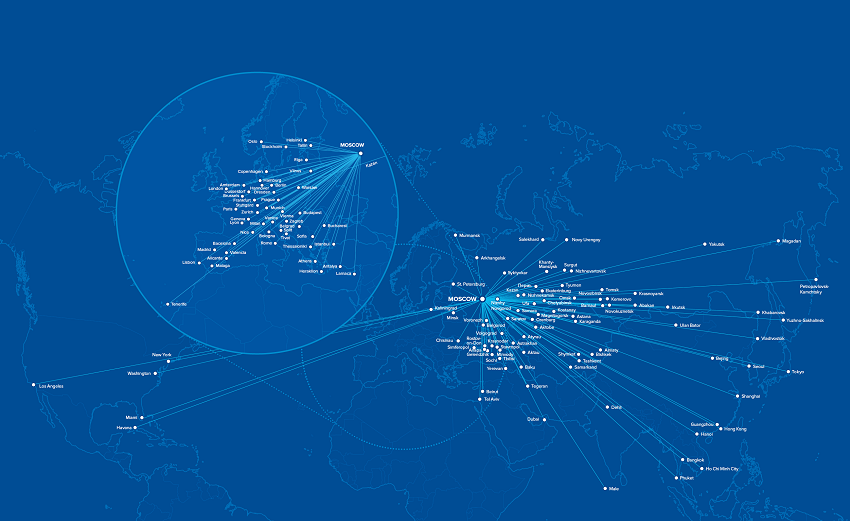

In 2017, Aeroflot Group’s network comprised 313 scheduled routes to 52 countries , including 35 unique routes operated by the low-cost carrier Pobeda.

Excluding the low-cost segment (Pobeda airline), the Group’s airlines operated scheduled flights on 278 routes. The number of scheduled routes remained almost flat during the year (down 0.4% year-on-year). Domestic scheduled routes increased by 1.4% while international scheduled routes were down by 2.2%. The total number of the Group-operated routes increased by 13,8% to 429, driven by charter flights.

During 2017, Aeroflot Group’s airlines launched scheduled flights to 13 new destinations, including 9 domestic and 4 international.

Number of Aeroflot Group’s routes

| 2016 | 2017 | Change, % | |||||||

| Sch. | Chart. | Total | Sch. | Chart. | Total | Sch. | Chart. | Total | |

| International | 139 | 116 | 214 | 136 | 146 | 240 | (2.2) | 25.9 | 12.1 |

| Domestic | 140 | 60 | 163 | 142 | 86 | 189 | 1.4 | 43.3 | 16.0 |

| Medium-haul | 253 | 161 | 341 | 252 | 219 | 392 | (0.4) | 36.0 | 15.0 |

| Long-haul | 26 | 15 | 36 | 26 | 13 | 37 | - | (13.3) | 2.8 |

| Total | 279 | 176 | 377 | 278 | 232 | 429 | (0.4) | 31.8 | 13.8 |

Flights from Saint Petersburg to Baku and Yerevan under 100% commercial management of Rossiya airline were discontinued as part of the network optimisation and Group performance improvement. Flights from Saint Petersburg to Gelendzhik were suspended due to the fleet restructuring efforts.

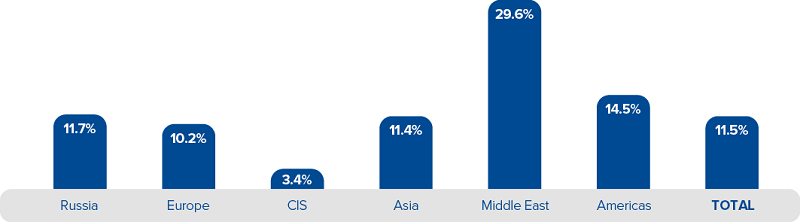

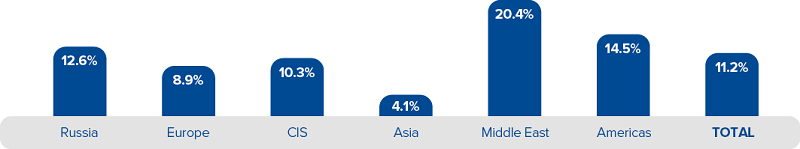

In 2017, the number of Aeroflot Group’s scheduled flights grew 11.5% year-on-year. The Middle East segment reported the highest growth due to the recovery of the flight schedule to Turkey (Istanbul, Antalya) to historic levels, and the increased frequency of flights to Tel Aviv in 2016.

European destinations saw the number of scheduled flights increase by 10.2%. The frequencies of flights to London, Rome, Milan, Hamburg, and some other European cities increased (including throughout 2016). Aeroflot airline launched a route to Lisbon, the capital of Portugal and Rossiya airline launched a flight to Barcelona from Moscow’s Vnukovo airport.

The number of scheduled flights to Southeast Asia was up 11.4%, including due to the higher frequency of flights to Hanoi and Delhi.

The number of scheduled flights to the CIS increased by 3.4%, driven by the launch of the Kostanay route and more frequent flights to Yerevan and other key cities in the region.

The launch of the third daily flight to New York in the summer of 2016 and the higher frequency of flights to Miami pushed the number of scheduled flights to North and Central America up by 14.5%.

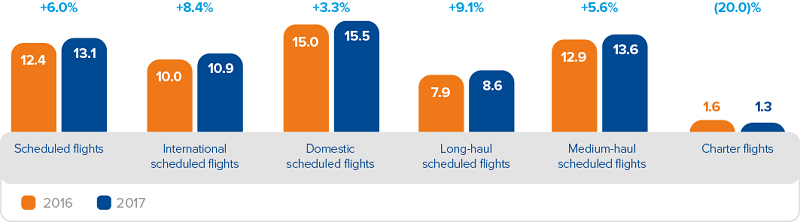

Aeroflot Group continued increasing the frequency of scheduled service to the most popular and lucrative destinations, with the average weekly frequency of scheduled flights in 2017 growing by 6.0% year-on-year (from 12.4 to 13.1). This figure grew 8.4% (from 10.0 to 10.9) for international and 3.3% (from 15.0 to 15.5) for domestic scheduled routes.

In planning its flight schedule, Aeroflot Group focuses on:

- improving the accessibility of Russia’s regions

- improving customer experience of non-stop flights

- optimising targeted connections on intercontinental (Asia – Europe, North America – Middle East), and inter-regional routes (Far East / Urals – Centre / South)

- maintaining and further developing the hub structure at Sheremetyevo airport

- growing the market share on existing routes and launching new destinations in large markets with high transfer traffic potential.

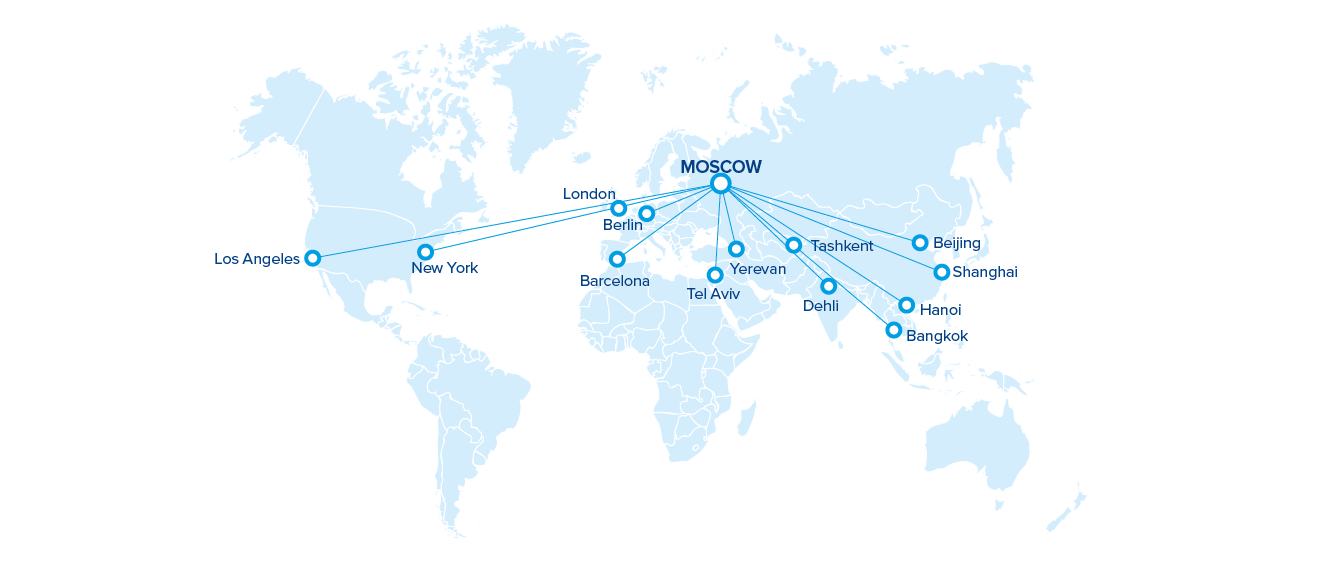

Aeroflot Airline’s route network development

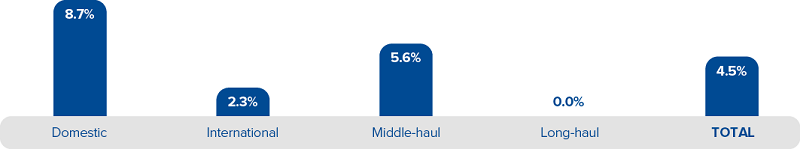

In 2017, Aeroflot airline’s network covered 139 scheduled routes to 51 countries (including Russia). The number of both international and domestic scheduled routes grew 2.3% and 8.7% year-on-year, respectively.

Aeroflot continued expanding its network by launching six new scheduled routes, including two international (from Moscow to Kostanay and Lisbon) and four domestic (from Moscow to Belgorod, Salekhard, and Khanty-Mansiysk, as well as from Sochi to Simferopol).

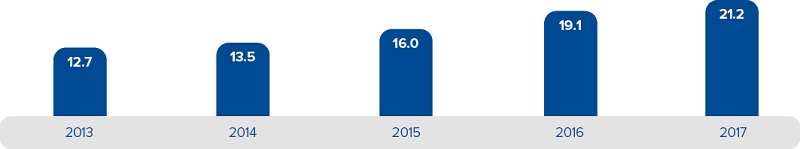

In 2017, the total number of Aeroflot airline’s scheduled flights grew 11.2% year-on-year due to the increase in capacity on the most popular routes and the above restructuring of the route network. The connectivity ratio for Aeroflot airline’s own flights improved from 19.1 in 2016 to 21.2 in 2017.

Aeroflot Group’s scheduled flights by region (2017 vs 2016)

2016 |

2017 |

Change, % |

|||||||

| Sch. | Chart. | Total | Sch. | Chart. | Total | Sch. | Chart. | Total | |

| International | 87 | 20 | 99 | 89 | 31 | 103 | 2.3 | 55.0 | 4.0 |

| Domestic | 46 | 13 | 48 | 50 | 25 | 64 | 8.7 | 92.3 | 33.3 |

| Medium-haul | 108 | 30 | 119 | 114 | 56 | 142 | 5.6 | 86.7 | 19.3 |

| Long-haul | 25 | 3 | 28 | 25 | - | 25 | - | - | (10.7) |

| Total | 133 | 33 | 147 | 139 | 56 | 167 | 4.5 | 69.7 | 13.6 |

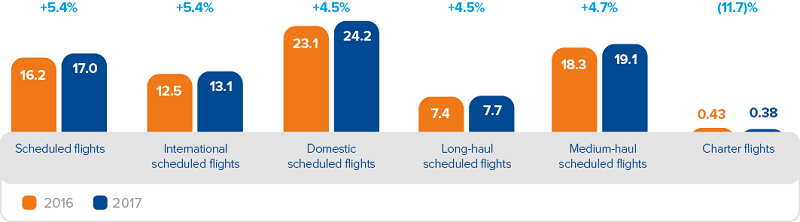

The average weekly frequency of Aeroflot airline’s scheduled flights grew 55.4%, from 16.2 to 17.0 flights per route per week. International and domestic scheduled destinations saw the frequency grow by 5.4% (from 12.5 to 13.1 flights) and 4.5% (from 23.1 to 24.2 flights), respectively.

Route Network

Subsidiary airlines’ route network development

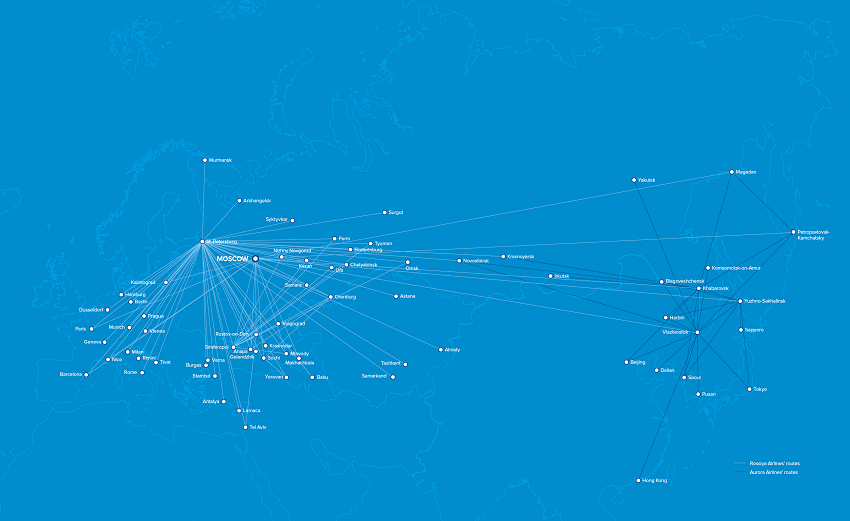

Rossiya airline

In 2017, Rossiya airline operated scheduled services on 110 routes to 22 countries (66 domestic and 44 international), including 83 routes under commercial management of PJSC Aeroflot.

Rossiya airline continued to enhance its route network to improve its operating and financial performance. Higher-demand routes from Moscow and Saint Petersburg to Sochi and Simferopol were operated using wide-body high-capacity Boeing 747s and Boeing 777s. Rossiya improved connections with flights from airports in Southern Russia on routes from Moscow to the Russian Far East.

The airline enhances its route network to create a regional transport hub at Pulkovo airport to provide services in the North-West region and improve its connectivity to other regions of Russia and cities in Europe. Rossiya airline’s route network from Moscow’s Vnukovo airport complements the Group’s network of high-demand routes.

Aurora airline

In 2017, Aurora airline operated scheduled services on 57 routes to three countries (43 domestic and 14 international), including 21 routes under commercial management of PJSC Aeroflot.

Aurora is focused on improving transport accessibility in the Russian Far East and accommodating the demand for flights both within this region and to such major Siberian cities as Irkutsk, Krasnoyarsk, Novosibirsk, and Yakutsk. Aurora also operates international services from Khabarovsk, Vladivostok, and Yuzhno-Sakhalinsk to South Korea, China, and Japan. Local flights between major cities and remote destinations within the region are an important part of Aurora’s route network covering 22 socially important destinations.

In the reporting year, the airline strengthened its position in the region’s international air transportation market, including through increasing the frequencies of its services from Vladivostok to Busan and Seoul, South Korea. Aurora also remained the only carrier operating flights from Vladivostok and Yuzhno-Sakhalinsk to Harbin (China), from Vladivostok to Busan (South Korea) and Dalian (China), and from Khabarovsk to Krasnoyarsk and Beijing.

Following the runway repairs at Yuzhno-Sakhalinsk airport, Aurora ramped up the frequency of its flights to Vladivostok and Khabarovsk, whereas the frequency of services from Vladivostok to Hong Kong was reduced to improve cost efficiency.

Aeroflot Group continues to integrate Aurora’s own domestic local routes into the Group’s network to improve travel experience and accessibility for passengers flying to/from destinations in the Russian Far East from/to other domestic and international destinations.

Pobeda airline

During 2017, Pobeda airline operated flights on 64 routes, including seasonal routes from Russian regions to the Black Sea resorts in Sochi and Anapa (48 domestic and 16 international), 35 of which were unique and were not serviced in 2017 by any other airline within the Group. Pobeda is based at Moscow’s Vnukovo airport and operates services from Moscow, as well as a number of regional routes.

Domestic flights from Moscow to Russia’s regions connecting the capital with key regional centres make up the bulk of the airline’s route network. During 2017, Pobeda launched fights to Saint Petersburg and Ulan-Ude.

It also continues to expand its regional programme which included the following routes in 2017:

- from Saint Petersburg to Yekaterinburg, Vladikavkaz, Volgograd, Makhachkala, Nalchik, and Rostov-on-Don

- from Yekaterinburg to Krasnoyarsk, Novosibirsk, Saint Petersburg, Sochi, and Anapa

- from Novosibirsk to Krasnoyarsk

- from Makhachkala to Saint Petersburg and Surgut

- seasonal flights from Sochi to six regional destinations including Yekaterinburg, Kazan, Nizhnekamsk, Perm, Tyumen, and Chelyabinsk, as well as from Anapa to Yekaterinburg and Perm

- international flights from Rostov-on-Don to Baku and Tbilisi and from Samara to Almaty.

Pobeda continued efforts to enhance its international route network and launched flights to Istanbul, Alanya, Baden-Baden, and Reus (Barcelona).

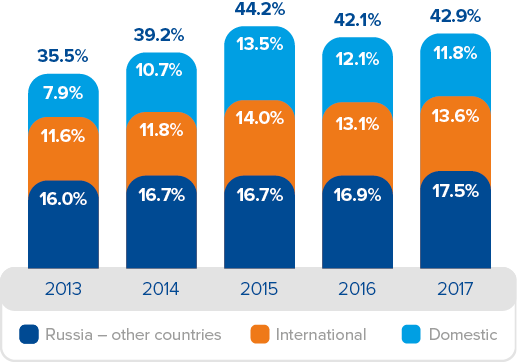

Transfer traffic on domestic and international routes

Aeroflot Group’s route network not only provides passengers with the benefits of flying point-to-point, but also offers travelling options with connections at Moscow’s Sheremetyevo airport, its main hub, and in base airports of regional airlines. The bulk of the Group’s transfer passengers are handled by Aeroflot airline, which takes advantage of Russia’s beneficial geographical position to pick up passenger traffic between Europe and Asia and from other O&D markets.

In 2017, the total transfer traffic on Aeroflot airline’s flights increased by 16.4% year-on-year to about 14.0 million passengers. Passengers in transit accounted for 42.9% of Aeroflot airline’s total passenger traffic in 2017.

The increase in the transfer passenger traffic was mainly driven by the transit services between Russia and other countries, reaching 17.5% of Aeroflot’s total passenger traffic. The share of international transfer was 13.6% while the domestic transfer accounted for 11.8%. International transfer has the highest impact since it provides the company with an opportunity to capture more value from international markets and global passenger flows.

Obtaining approvals and operating permits to increase the frequencies of services and launch new flights

In 2017, the Federal Air Transport Agency issued the following operating permits to PJSC Aeroflot and its subsidiaries under the commercial management of PJSC Aeroflot:

| Aeroflot airline |

Rossiya airline |

Aurora airline |

|

|

|

In 2017, permits were renewed for Aeroflot airline (for 17 routes) and Rossiya airline (for 16 routes) to operate services on Transaero’s routes until the end of the year with an extension option. Permits were not renewed for three routes on which Aeroflot, as agreed with aviation authorities, may now operate under its own permits (Moscow – London, Moscow – Tbilisi, and Moscow – Delhi – Singapore), and for two Rossiya’s suspended routes (Moscow – Nha Trang and Moscow – Istanbul). The permits were renewed for another year in February 2018 with an option to extend.

PJSC Aeroflot was appointed as scheduled services operator by the Russian Foreign Ministry on the following new routes: Moscow – Burgas and Moscow – Kaunas, and obtained a permit to sign a codeshare agreement with partner airlines to operate Moscow – Melbourne, Moscow – Auckland, and Moscow – Sidney routes.

Codeshare and interline agreements

Codeshare agreements enable Aeroflot Group to expand its route network adding both point-to-point flights and flights beyond the partner hubs, as well as increase the frequency of flights on existing routes.

In 2017, joint flights with Delta Air Lines were resumed on routes beyond New York, Los Angeles, and Miami. Aeroflot continued to expand partnerships under codeshare agreements on new routes with China Southern, Alitalia, Air Serbia, Air France, and Siberia Airlines.

During 2017, PJSC Aeroflot had 30 codeshare agreements with foreign and Russian airlines:

- Twenty agreements under which Aeroflot airline acted both as a partner operator and a marketing operator: Air France, KLM, Alitalia, Finnair, Czech Airlines, LOT-Polish Airlines, Bulgaria Air, Korean Air, Air Serbia, MIAT, Air Baltic, Air Europa, Garuda Indonesia, Icelandair, Kenya Airways, Saudi Arabian Airlines, China Eastern Airlines, China Southern Airlines, Delta Air Lines, and Siberia Airlines

- Four agreements under which Aeroflot airline acted as a partner operator only: Cubana de Aviacion, Iran Air, Tarom, and Middle East Airlines

- Four agreements under which Aeroflot airline acted only as a marketing operator, selling partner flights under its code: Adria Airways, Air Malta, Bangkok Airways, and Royal Air Maroc

- Two codeshare agreements with Aeroflot Group’s airlines under special arrangements with Rossiya and Aurora (commercial management)

PJSC Aeroflot’s major partners by scope of operations under their codeshare agreements were foreign-based Alitalia, Air France, LOT Polish Airlines, Finnair, and KLM and Russian-based Aeroflot Group’s carriers and Siberia Airlines.

As at the end of 2017, PJSC Aeroflot had interline agreements with 134 carriers, including four Russian carriers and four CIS-based airlines.

Membership in the Skyteam Alliance

As a member of the SkyTeam Alliance, Aeroflot may expand its route network while offering its customers access to the global alliance’s unique product, and providing Aeroflot Bonus members with an opportunity to enjoy the privileges on the flights of other SkyTeam Alliance members.

In 2017, the Alliance’s aggregate route network comprised 1,074 destinations in 177 countries. SkyTeam’s members, including Aeroflot airline, were making a total of 16,609 flights on a daily basis.

SkyTeam Alliance had 20 members in 2017, including Aeroflot – Russian Airlines, Aerolineas Argentinas, Aeromexico, Air Europa, Air France, KLM, Alitalia, China Airlines, China Eastern Airlines, China Southern Airlines, Czech Airlines, Delta Air Lines, Kenya Airways, Korean Air, Middle East Airlines, Saudi Arabian Airlines, TAROM, Vietnam Airlines, Xiamen Airlines, and Garuda Indonesia.

As a SkyTeam partner, Aeroflot carried over 513 thousand passengers in 2017 under codeshare and interline agreements with Alliance members. About 334 thousand Aeroflot passengers were carried by its SkyTeam partners.

Interline employee travel agreements

Since 2006, PJSC Aeroflot has been a member of ZED/MIBA FORUM, a non-profit organisation uniting over 230 member airlines and regulating the offering of special terms for employee personal and duty travel.

As at the end of 2017, PJSC Aeroflot teamed up with 63 airlines under interline employee travel agreements, including with SkyTeam Alliance member airlines.

1 Due to the separate status of the low-cost segment, the data on Aeroflot Group’s route network includes the routes of Aeroflot airline and subsidiaries excluding Pobeda, unless otherwise stated.