Financial and Operational Results

Based on the Company’s updated Development Strategy, Metalloinvest seeks to:

- become the global leader in the production of HBI/DRI as well as the leading supplier of iron ore products in Russia;

- to remain a high-margin and efficient producer of high-quality steel products on regional and international markets.

102-2

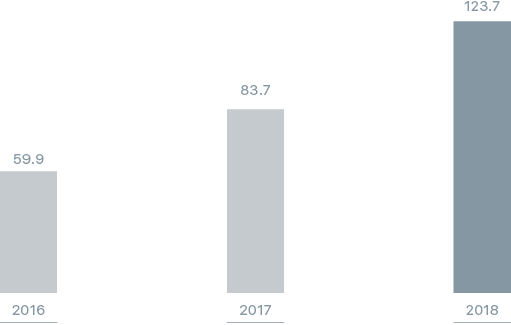

To achieve these goals, Metalloinvest is constantly enhancing the quality of its products and improving production processes, which contributed to the growth in key performance indicators seen in 2018. One of the Company’s objectives is to boost the effectiveness of sustainable development practices along with reducing its negative environmental impact while simultaneously scaling up production. The Company strives for maximum efficiency and is always seeking opportunities to build capacity while investing heavily in R&D to improve its products and existing technologies. The Company spent RUB 123.7 million on R&D in 2018, a 48% increase on the previous year.

Key production indicators in 2018

The production of all Metalloinvest’s core product types increased during the reporting period.

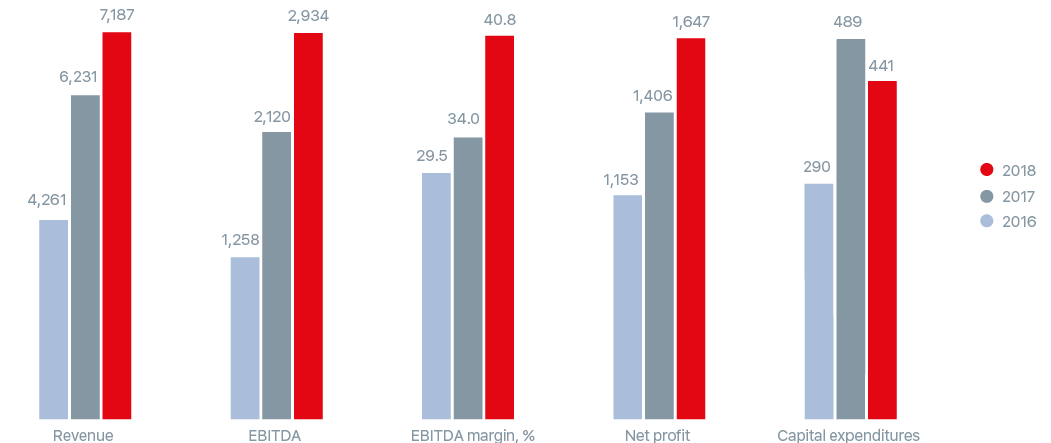

Metalloinvest boosted its main financial indicators in 2018 due to growth in sales of high value-added products and a favourable market environment, in particular an increase in global iron ore and steel prices..

For more details on the Company’s operational results, see the section Operational Results in the 2018 Annual Report.

Main changes seen during the reporting period:

- 17.6% increase in revenue from sales of metallurgical products;

- 13.0% increase in revenue from sales of iron ore products;

- the proportion of high value-added iron ore products (pellets, HBI) sold in overall sales of products of this type increased to 84.1%;

- the share of the domestic market in the Company’s consolidated revenue remained at 40.1% in 2018.

Key financial indicators

The Company saw a significant improvement in its financial performance in 2018 due to improved loan portfolio parameters and the introduction of best corporate governance practices.

| Stakeholder | 2016 год* | 2017 год | 2018 год | |

|---|---|---|---|---|

| Direct economic value generated, USD million | 4,496 | 6 294 | 7,257 | |

| Revenue | Wide range of stakeholders | 4 261 | 6,231 | 7,187 |

| Income from financial investments | 235 | 63 | 70 | |

| Income from the sale of tangible assets | 0 | 0 | 0 | |

| Economic value distributed, USD million | -6,823 | -5 992 | -5,463 | |

| Operating expenses | Employees, suppliers, and contractors | -2 910 | -2,910 | -4,102 |

| Including salary | Employees | -596 | -719 | -670 |

| Other employee payments and benefits | Employees | -10 | -8 | -7 |

| Charitable donations | Local communities | -52 | -89 | -80 |

| Payments to capital providers | Shareholders and investors | -3 719 | -1,505 | -752 |

| Including dividends paid | -3,404 | -1 180 | -436 | |

| Including financial expenditures | -315 | -325 | -316 | |

| Budget contributions | Authorities | -132 | -430 | -522 |

| Including profit tax | -83 | -372 | -460 | |

| Economic value retained, USD million | -2,327 | 302 | 1,794 | |

* Dividends in the amount of USD 3,382.1 million that were paid as part of the consolidation and transfer of the Company’s shares into Russian jurisdiction are not included in the total amount for the year since the funds were returned to the Company to repay previously issued intragroup loans.

For more details on the Company’s financial results, see the section Financial Results of the 2018 Annual Report.

Key product sales indicators

102-2

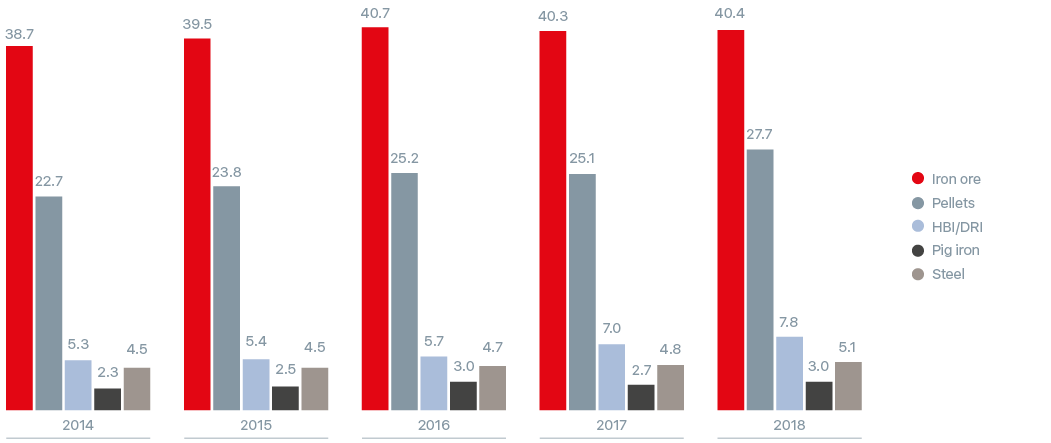

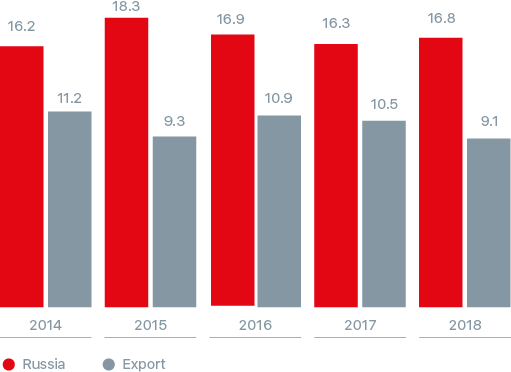

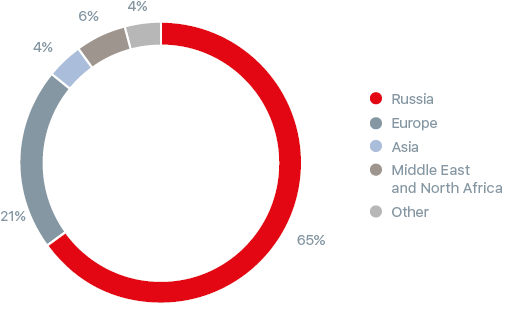

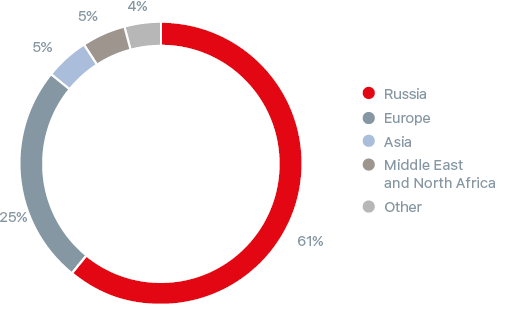

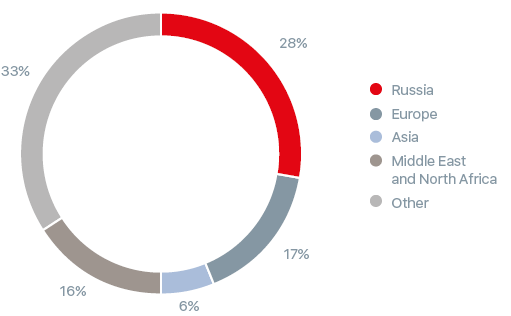

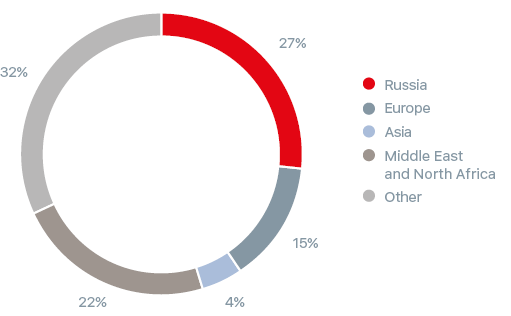

Metalloinvest held on to its leading position in key segments of the international iron ore market during the reporting period despite a slight decrease in sales of iron ore products (by 3.5%). This decrease was due to changes in the product range: pellet shipments increased by 9.3%, while HBI/DRI shipments grew by 18.9%. Iron ore exports accounted for 19% of the total ore produced by the Company versus 26% in 2017.

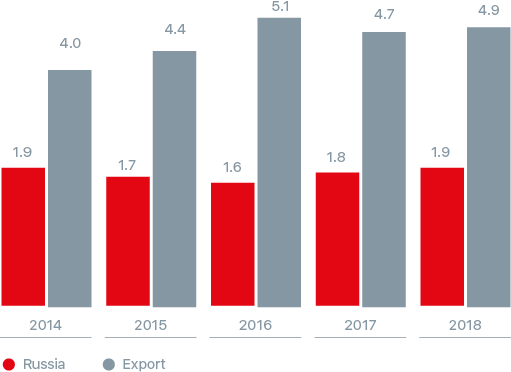

The Company managed to maintain steady growth in shipments of steel and pig iron both in Russia and on foreign markets in 2018. Supplies of steel and pig iron to Russian customers totalled 1.9 million tonnes, while exports amounted to 4.9 million tonnes.

102-6,102-7[million tonnes]

[million tonnes]

Customer focus and product quality assurance principles

The fundamental principle of Metalloinvest’s engagement with customers is to ensure a level of quality that meets advanced global standards. The Company is committed to building long-term relationships with customers and serving as an open and reliable partner.

Metalloinvest regularly interacts with the customers of its products: it conducts surveys in order to further assess satisfaction with the service and quality of its products and also organises interviews with on-site customer surveys. Based on an analysis of the feedback obtained during the survey and in-person meetings, the Company makes changes to its marketing and production strategy taking into account the dynamics on the markets where its clients operate and their changing expectations regarding products.

For more details on production and product shipments, see the section Operating Results of the 2018 Annual Report (pp. 48-52).